🔍 Creating an impact VC methodology

Impact Supporters #1

You are reading Issue #1. Thanks for being here. If you have comments or feedback, drop me a message 🧑💻

I love the concept of Impact VCs. On the one hand, because they are part of pushing innovation that creates a better and more sustainable society forward, and on the other hand because they try to rethink some of the ways that VCs have been operating for the last decades to cater to the needs of impact start-ups. But how different are they really? 🤷

In this first article, I will discuss what decisions impact VCs have to make when building their investment thesis and investment approach. It’s the questions that impact VC GPs all ask themselves when creating new impact VC funds - and they are hot on the market. In 2022 alone, there were 47 new impact funds in Europe.

I wrote my thesis at HEC Paris about how to adapt the VC methodology as an impact VC. This article is partly based on the interviews with 20 leading impact VC firms from all over Europe from my thesis and partly on research. Enjoy!

First - quick methodology check ✅:

When I talk about impact VCs here, it is VC investors from Pre-Seed to Series C. The conclusions are relevant for anyone but especially for early-stage investors because dynamics are different at growth stage.

And when defining impact VCs, I include all firms in the “Impact” category below. They can either be aiming for market rate returns or accept lower returns with the goal of optimizing the impact they have.

Source: Own design based on Bridges Fund Management

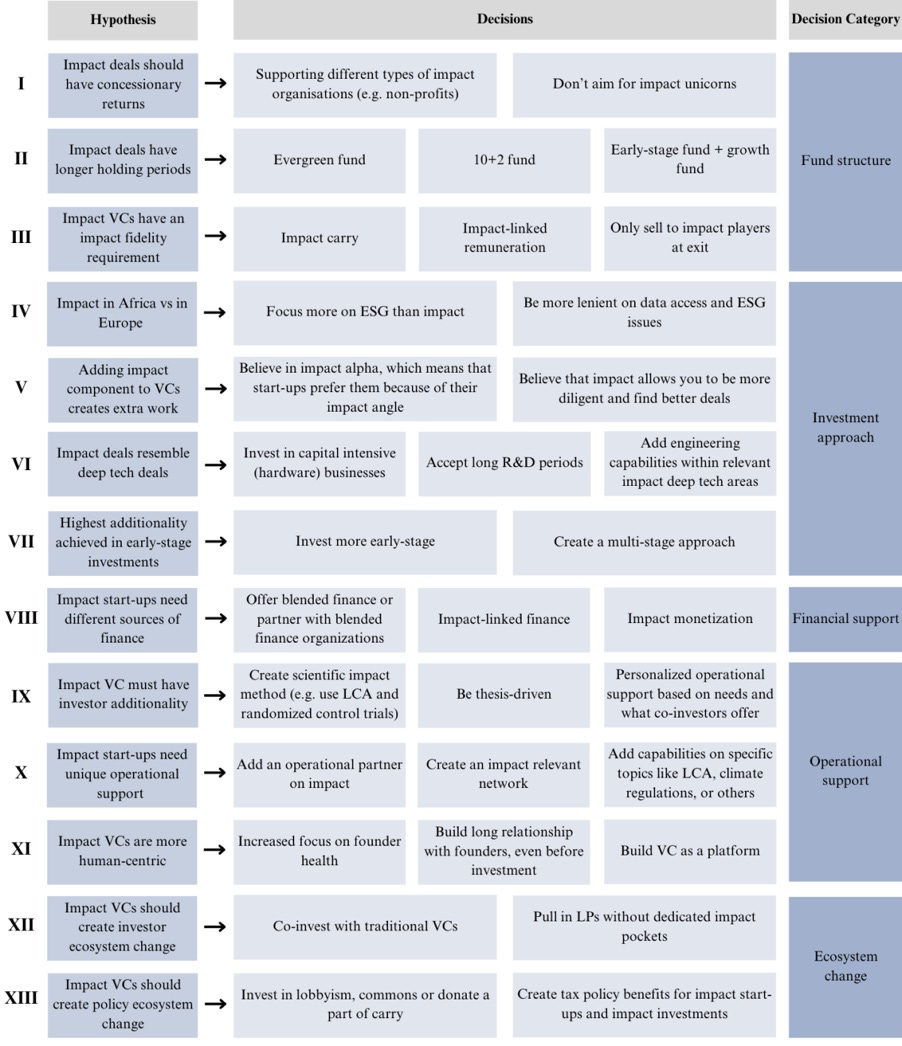

In my thesis, I created the Impact VC Decisions Framework (cf. see below). The framework includes 13 different hypotheses about what uniquely identifies impact start-ups as well as in total 33 different decisions that impact VCs can take to adapt their VC methodology, with each decision linked to a specific hypothesis. The goal of this framework is to allow impact VCs, traditional VCs that are interested in impact, impact start-ups, and LPs to understand what decisions impact VCs can take to support impact start-ups and what inherent assumption each decision is built on.

All hypotheses and decisions fall within 6 categories:

Structural differences between impact VC and classic VC

Fund structure

Adaptation of investment approach

Financial support

Operational support

Creating ecosystem changes.

There is of course no single recipe for building an impact VC and it highly depends on what hypotheses each VC believes in for impact start-ups. Mapping out these hypotheses and their subsequent decisions helped me question what I believed in when looking at Impact VC theses.

We will deep-dive into different hypotheses and decisions in the next articles - below are some of my overall thoughts on each hypothesis.

Fund structure

When building a new impact fund one of the first things to decide is the structure that you want to build. There are three primary questions that GPs have to take a stance on.

(i) Do you believe that impact VCs should have concessionary returns? If yes, then it means that your LPs and GPs are paying for the extra impact that they are creating by accepting lower returns. And if no, then you often invest in start-ups that traditional funds could have invested in as well. And you have to believe in the concept of impact unicorns as you would want to be able to return the value of your fund.

(ii) Do impact deals have a longer holding period? Some investors believe that it takes longer to build an impact company because you are building something for a lasting impact and it can include hardware.

(iii) Do impact VCs have an impact fidelity requirement on top of their fiduciary duty? If yes, then you need to build mechanisms into your fund structure that ensures alignment between GP and LP on impact.

Investment approach

When creating an impact fund, you have to make early decisions about how you will approach your investments.

(iv) Do you want to have your impact in Europe or in emerging countries? You can have an impact and solve primary needs in both places - but in Europe, it will often be climate primary needs or social primary needs for few as compared to solving social primary needs for the many in emerging countries.

(v) Does it create extra work to be an impact VC? You could assume that adding an impact component on top of the classic VC model should mean more work on each deal and, therefore, a risk of losing deals. Being an impact VC must create value elsewhere to counter this.

(vi) Are impact deals comparable to deep-tech deals? If yes, then you have to invest in hardware, accept long R&D times, and build better engineering capabilities in the team.

(vii) At what stage do you have the highest impact? The largest funding gap for impact start-ups is currently at growth stage, but you have a bigger role in picking the winners of the future at the early stages.

Financial support

The very essence of what VCs do is to provide financing to start-ups. An important question to ask is:

(viii) Do impact start-ups need other types of financing and how can I provide that? They have access to grants and cheaper debt because of the impact they have. Impact VCs can support their start-ups in getting access to this and monetize their impact.

Operational support

The utility and need for operational support is debated in the VC ecosystem but in my chats with impact investors it was one of the things that were repeated the most.

(ix) Should an impact VC have investor additionality? If yes then the impact VC has to add something unique on the impact side to its investments.

(x) Is operational support different for impact start-ups? Some investors are adding specific internal capabilities and building unique impact networks to better support impact start-ups.

(xi) Are impact VCs more human-centric? Interestingly enough in my chats with impact investors, being more human than traditional VCs was repeated again and again. I think it both comes from the people working in impact VCs and also different expectations from start-up founders.

Ecosystem change

Impact VCs are not just a trend. They are trying to create systemic change in the VC ecosystem. They, therefore, have some questions to answer when it comes to creating ecosystem change.

(xii) How does an impact VC participate in creating a movement towards impact in the global VC ecosystem? This counts for interactions with other VCs, start-ups, and LPs.

(xiii) How does an impact VC interact with the policy ecosystem? Regulators have a lot of power in supporting and ensuring the success of impact VCs. The EU’s sustainable finance disclosure regulation (SFDR) for example helps identify which funds are truly impact funds and which aren’t.

Thanks for reading! You can refer back to the Impact VC Decisions Framework for an overview of the hypotheses and decisions that impact VCs have to consider when building a new fund.

Let me know what you think. This is the first article of its kind. Please subscribe to stay updated on impact VC articles. See you next week for another issue! 👋