You are reading Issue #2. Thanks for being here. If you have comments or feedback drop a comment or DM me 🧑💻

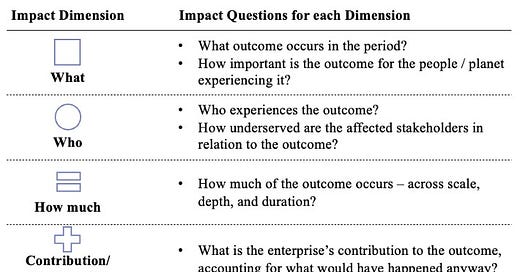

The global standard framework for measuring impact is the one made by the Impact Management Project. When measuring impact, you define the impact produced by asking the what, who, size, and risk of the impact, but you especially ask yourself about the “additionality” that you create. Additionality is defined as what you are contributing that wouldn’t have happened otherwise. This week, I have dug into what that actually means 🔍

Source: own design based on Impact Management Platform

Additionality as an impact VC can be split into two categories - enterprise additionality and investor additionality.

Enterprise additionality is the unique contribution to society that the start-up you invest in has through its product - how it changes an industry or a way of working for a certain group of people to create a better society. An example of impact could be a start-up in the fashion industry that is enabling circular economy in the industry by creating a second-hand reselling website for brands. If this start-up didn’t exist, some of these old pieces of clothing would not have been refurbished and reused.

Investor additionality is ensuring that “an investment increases the quantity or quality of the enterprise’s social outcome beyond what would otherwise have occurred” (Brest & Born, 2013, p. 22).

The question that impact VCs ask themselves is:

Is it enough to just invest in companies with enterprise additionality or do you need to add investor additionality on top of it?

I would argue that you need investor additionality in order to be an impact VC because otherwise, you are investing in companies that traditional investors could do either way 🕵 Here are the ways that I have encountered investor additionality (and there might be more):

Investing in impact start-ups when the round is not oversubscribed and therefore the start-up would not have received funding if they weren’t there

Creating a stronger methodology than other impact VCs based on science. I have seen this done on deep LCA (Life Cycle Assessment) expertise. And more and more impact VCs mention using randomized control trials as a way of adding investor additionality on the social impact side.

Being thesis-driven in order to identify the most critical problems impact-wise and making sure these solutions get backed

Adding personalized operational support to a larger extent than other VCs or more specific on impact. This, however, often requires a seat at the decision-making table in order to really create a change in the start-up.

Aiming for concessionary returns in order to increase the impact that they have through deals. This is, however, characteristic of impact-first VCs and not impact VCs.

The additionality that you bring as an impact VC also doesn’t have to be linked directly to a specific deal but can be on the ecosystem as a whole 🌍 I have seen 3 examples of this:

Doing only/primarily deals together with traditional (non-impact) investors and trying to attract these types of investors to new types of deals. The end goal is to move capital into more impact deals

Convincing traditional LPs to invest in impact as it has a higher impact on the world to raise funds from traditional investors than taking the money from pockets already dedicated to impact

Engaging with governments to create a favorable environment for all impact start-ups and VCs through tax benefits and defining what makes an impact VC for example

Some research even shows that just by the mere fact of a company being backed by an impact investor rather than a traditional investor, it increases, the company’s probability of success. You could, therefore, argue that all impact investors have natural impact additionality. But this still needs to be proven over time.

There are discussions on whether the impact additionality is higher at different stages of VC investing. On the one hand, at the earlier stages of a start-up, companies are early in their reflections and one piece of advice can mean the difference between bankruptcy or not and ensure that the company becomes an impact unicorn over time. On the other hand, later-stage VCs have more time to dedicate to each start-up as they make fewer investments, and they have a key role to play in ensuring that companies keep their impact mission at their heart. When an impact start-up stops having a tight link between its business and its impact mission then it’s called mission drift - and an impact VC can play a strategic role in ensuring this doesn’t happen for its start-ups (Cetindamar & Ozkazanc-Pan, 2017).

The funding gap is also existing at all stages of impact VC, and especially at the very early stages and very late stages of impact VC as can be seen in the graph below - so their funding creates extra additionality. Additionality can be found in all types of impact VCs if they are intentional about it.

Source: snip from Revent’s impact report 2022

To conclude, impact VCs must somehow add investor impact additionality on top of the enterprise additionality that their start-ups create to differentiate themselves from a classic VC that could also invest in impact startups. There are many ways to do this as aligned above - and all types of investors can do it, small and large, early-stage and late-stage, and national and international ✅

Thanks for reading this week’s newsletter! Let me know what you think - either in the comments section or in my DMs. This is the second article of its kind, the first one was on building an impact VC methodology - you can find it on my page. Please subscribe to stay updated on impact VC articles. See you next week for another issue!👋

Links to articles mentioned in this week’s newsletter:

Other research investigating the topic of additionality is https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4233480

It analyzes the following four hypotheses:

1. Impact investors prioritize portfolio companies that would have trouble attracting

traditional financing;

2. Impact investors prioritize poorer or otherwise disadvantages regions of the US and

the world;

3. Impact investors are pioneers in new industries and they utilize their capital to

attract traditional investors;2

4. Impact investors exhibit more risk tolerance and patience