Fundraising gap in Impact Growth Equity, interview with Rémi Said (Partech) 🌅

Impact Supporters Issue #16. Thanks for being here. If you have comments or feedback drop me a message.

Disclaimer from August Solliv: Everything that I write here is my own opinion and my research, and is not affiliated with any current or former employments i.e. it’s my evening and weekend work 😉

Greetings, Impact Supporters! 🌍 It’s August Solliv 👋 Welcome to the next article in the series where I interview top impact VCs about specific impact topics! We will be diving deep into impact growth equity and what is unique about growth investments (Series B and C) 📈

This week’s interviewee is Rémi Said, Co-Founder and General Partner at Partech Impact. Rémi is an investment expert based in Paris. He will share insights on impact growth equity with us. This article is a special one as I previously worked at Partech Impact and know Rémi very well 🌟 I hope you enjoy the read as much as I enjoyed the conversation!

Table of contents:

Rémi Said intro 👋

Partech Impact intro 💼

Funding gap in impact growth equity 📣

Value-add of a growth investor 📈

Market status 🌅

Climatetech premium 💲

Main industries at growth stage 🏭

Main drivers 🏎️

HW vs SW at growth stage 🖥️

Collaboration with the ecosystem 🤝

Meet Rémi Said 👋

Rémi is the Co-Founder and General Partner of Partech Impact, which was launched 18 months ago. Previously, he was Executive Vice President and part of the European leadership group at the global Private Equity firm, Bain Capital, and before he was Associate Partner at McKinsey & Company working notably with Private Equity and Tech 📡

Meet Partech Impact 💼

Partech has always been a pioneer in its DNA 🧬 12 years ago, Partech launched one of the first Seed funds in Europe focused on tech. 8-9 years ago, Partech launched the first digital growth fund in Europe. 6 years ago, it launched the first venture tech fund in Africa.

Partech Impact is the most recent innovation of Partech 💡 Partech Impact is bridging the gap in the market between more than 💯 early-stage venture funds and the very large impact investment firms. Partech Impact invests in companies that have reached commercial maturity and have a clear and strong business model to support their scale-up 🚀 and to become European or Global Impact champions. The ambition is to invest in 15 companies out of a current pipeline of 2800+ companies.

Partech Impact invests in:

Decarbonization 🍀

Energy 🔋

Circular economy ♻️

Agritech 🌾

Mobility 🚗

Smart citiy and construction 🏗️

Health and Inclusion 🏥

Why is there a funding gap in impact growth equity, and why has it not been filled yet? 📣

The gap🫸 🫷exists because the impact VC ecosystem is maturing. There is an increasing amount of companies that are reaching commercial maturity, and they need more capital to support their future growth. Neither the early-stage, nor the large digital growth fund or buyout funds can play that role. The same happened in the generalist tech space 10 years ago when Partech launched its digital growth fund after a lot of early-stage funds had helped support early digital innovation.

The 💯s of early-stage impact and climate venture funds that already exist will keep investing in the early innovation. However, Remi believes that the need for growth capital will be filled by new funds such as Partech Impact which has different capabilities and different teams. Partech Impact can only back 15 companies, so there is space for a few players positioning themselves on the segment.

Traditional tech growth funds can’t invest in the impact growth space because they start becoming too big 🔮 They follow the maturity of their own separate digital ecosystem and tech growth generalist firms have all raised around €700m+ funds today and invest €30-70m tickets compared to impact growth funds’ €20-30m tickets.

So the ecosystem is made up of:

Early-stage venture funds that are too small for impact growth companies

Traditional tech growth funds that can be too big for impact growth companies

Large impact buy-out investment firms that are too big and want to raise debt in cash-profitable companies

This explains the impact growth funding gap.

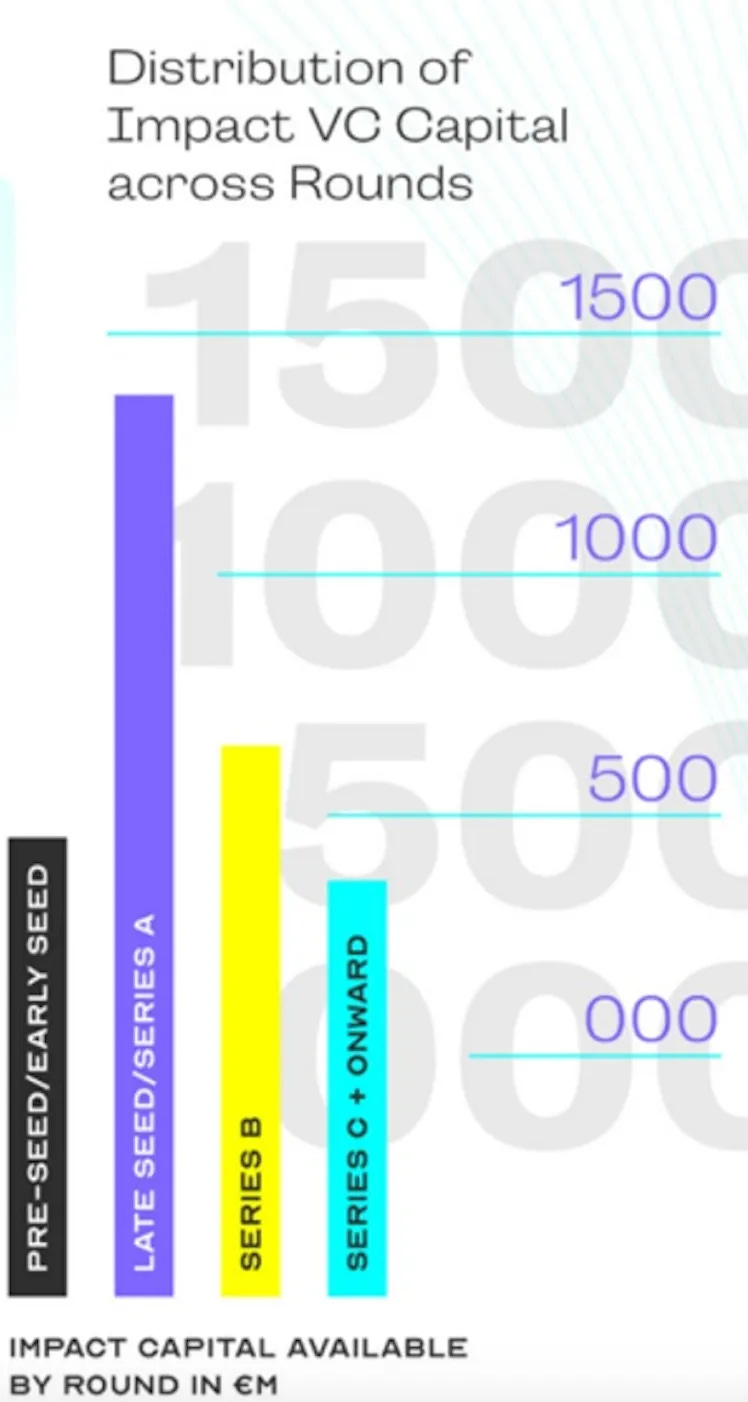

Data also shows that the growth stage is underfunded and needs more funds to support the emerging impact scale-ups:

Source: Snip from Revent’s impact report 2022 [added by the author, August Solliv]

How can an impact growth investor prepare an impact scale-up for the next steps of their journey? 📈

Rémi believes that it is as hard or even harder to go from €10m to €100m in revenue as it is to go from €0m to €10m in revenue. When going from €10m to €100m, you need to build foundations 🧩 to change your organization from start-up mode to company mode. You recruit additional layers of management and executives, structure your board, you double down on your go-to-market, open new countries, do M&A, etc. It’s a bunch of skills and tasks that most founders he meets do for the first time in their career, but that a growth investor like Partech Impact is a veteran at 🎖️ A growth investor can add value in key departments such as strategy, operations, recruitment, and organization.

A second element that Partech Impact brings to its start-ups is the journey towards EBITDA and cash profitability, both through additional funds and added capabilities. Until the growth equity stage, start-ups usually focus only on growth, but at growth equity stage the journey towards cash profitability starts 💰 while keeping solid revenue growth.

Is Partech Impact early on the market or is the market already mature? 🌅

There are already start-ups that are mature on the market so it is not too early, says Rémi. Partech Impact has already made a deal and has some interesting potential deals coming up in the next weeks 👀

Rémi believes that the market is going to be increasingly ready in a couple of years and expects to be overwhelmed with new incoming opportunities at that point.

To sum it up, the market is already there, the market is growing fast, and the market will continue to grow.

Are some of the start-ups that you see overvalued? 💲

Rémi doesn’t believe that valuations are completely off. He sees that there is sometimes a premium on climatetech today 💲 But overall, Rémi believes that a climatetech premium is not an issue as he believes it is backed by strong growth potential and that it will still be there in 5-7 years when Partech Impact will be exiting investments.

Are some industries more mature today? 🏭

Partech Impact is a thematic investor searching for B2B companies riding on trends that are deeply impacting existing value chains. Partech Impact believes this type of companies can achieve high sustainable growth as they are linked to changes in existing value chains. The trends that Partech Impact has identified are often broad forward by national or EU regulation in recent years. Therefore, many of the companies they look at were started 5-6 years ago and have been riding on a wave of regulation 📑

There are definitely some industries that are more mature than others. An example of a mature industry is electrical mobility 🚗 The whole industry is preparing itself for a scenario in which there are no more fuel vehicles sold 10 years from now. This creates a lot of opportunities for companies producing electrical vehicles (EVs), companies selling to EV producers, as well as for electrical charging companies.

Partech Impact looks for deals across all the 7 industries mentioned earlier and they would love to make an energy deal, an agtech deal, a mobility deal, etc. 🖋️

What are the main drivers of impact start-ups at growth stage? Is it just regulation? 🏎️

There are different drivers for different industries. Regulation definitely has a clear role to play as mentioned previously. But Partech Impact also see corporate behaviors to be driving a lot of change in some industries. When corporates change towards sustainable behaviors then it pushes all competitors to do the same, and it implies changes throughout the supply chain and creates opportunities for start-ups.

How do you think about hardware vs software in impact start-ups at growth stage? 🖥️

Partech Impact is investing in companies that 5-years down the line should be growing, sustainable, and cash profitable.

Software companies at €5-8m of revenue have a clear pathway 5 years down the road to fulfill the criteria. Investing in hardware companies is a little different. Either you take them at €5-8m of revenue, but then they will take more than 5 years to become growing, sustainable, and cash-profitable companies. Or you invest in them later because for industrial players to be cash profitable you need a high level of gross margins, which usually can only be reached through scale 🏭

Rémi believes that the question is not whether you should invest in software or hardware at growth stage. It is rather what is the perfecti timing for investing in a hardware vs software player to ensure the path to profitability. For hardware players that depends on the level of gross margin, the scalability of the CAPEX, and the ability to reach scale with a modular approach rather than an up-front investment.

How do you collaborate with earlier stage funds to identify companies at the right time for your thesis? 🤝

Rémi says that he likes the ecosystem a lot. There is a true spirit of collaboration of support 🫂 It is a group of people with a lot of talent that all share a very similar impact DNA. Partech Impact is not in competition with other funds as they rarely have overlapping theses so they try to cooperate as much as possible and share thoughts on industries and start-ups with other funds regularly.

Thanks for reading this week’s newsletter! Let me know what you think of this article and who else I should interview in this series - either in the comments section or in my DMs. Please subscribe to stay updated on articles about everything related to impact VC - and share with friends and colleagues. See you next week for another issue! 👋

~ August

(As these photos show, I’m an actual human writing this newsletter. Not AI. 🤖)