How family offices think about impact VC, interview with Marie Freville (Kimpa - Impact Investing) 💼

Impact Supporters Issue #31. Thanks for being here. If you have comments or feedback drop me a message.

Disclaimer from August Solliv: The views expressed are solely my own i.e. it’s my Sunday fun work 😉

Key insights:

Interview with Marie Freville, senior analyst at Kimpa

Family offices are highly regionalized

Family offices do portfolio optimization and avoid having more than 10-15% of their assets in impact VC

Family offices don’t disclose their fund investments as they wish to be discreet about the size of their wealth

Kimpa uses a different impact methodology per asset type and indexes that score based on the maximum impact potential per asset class

Impact debt is interesting for family offices as it has a different risk-return profile and it is key for scaling hardware

Kimpa appreciates when GPs partner with NGOs to secure expert knowledge on specific impact sectors

Greetings to 2k+ Impact Supporters! 🌍 It’s August Solliv 👋 Let’s talk about family offices in impact VC. Here is what we discussed about impact VC with Marie Freville (≈10 min reading time):

Analyzing the impact of impact VC funds 🔍

Analyzing non-impact metrics of impact VC funds 📊

Why family offices stay discreet 🤫

Characteristics of family offices 🏠

Investing for impact or returns 💰

Impact debt vs impact equity investments ⚖️

How LPs look at other LPs 👀

Meet Marie Freville 👋

Marie is a Senior Analyst at Kimpa. Marie grew up between rural France and Belo Horizonte, an industrial city in Brazil. This upbringing sensitized her to social inequalities and climate change from a young age. Marie was one of the first employees at Kimpa and contributed to structuring the Investment Solutions team. At Kimpa, Marie advises families and entrepreneurs on their impact investments with a focus on regenerative agriculture and circular economy 🌱

Meet Kimpa 💼

Kimpa is an advisory firm whose mission is to steer capital towards high-impact projects. It was founded in 2020 by 3 friends who came together as they wanted to create a business that was useful for the next generations. Kimpa advises private individuals, corporates, and institutional investors to define their investment thesis and deploy their capital with a focus on impact 🚀 Kimpa sources and analyzes deals, negotiates investment terms, and monitors their clients' portfolios. Each client has their own impact thesis, where they pick specific environmental and social themes as well as financial criteria (horizon, expected returns, liquidity).

Kimpa works with all types of non-listed investments, including start-ups, funds, real estate, and renewable energy projects 🌞 – and has helped their clients invest in funds such as ABAC, Ring Capital, and 2050. For their private clients, Kimpa also offers family office services 🏠 These services are typically used by business families who have governance challenges, or entrepreneurs who have exited and need wealth management advice. Kimpa aims to become Europe’s largest collective of private impact investors and to achieve this they also advise other Single and Multi-Family Offices.

Analyzing the impact of impact VC funds 🔍

Kimpa’s first investment filter is impact. In their view, impact has to be 1. directly correlated to the core business, 2. additional, and 3. measurable 📊 For funds, this translates into vehicles that are investing in impact-native start-ups but also vehicles that invest in traditional businesses and will strongly contribute to the improvement of the business in terms of environmental & social performance. Marie says that they select funds based on the team's impact intention, their track record, and their capacity to measure and report on impact KPIs.

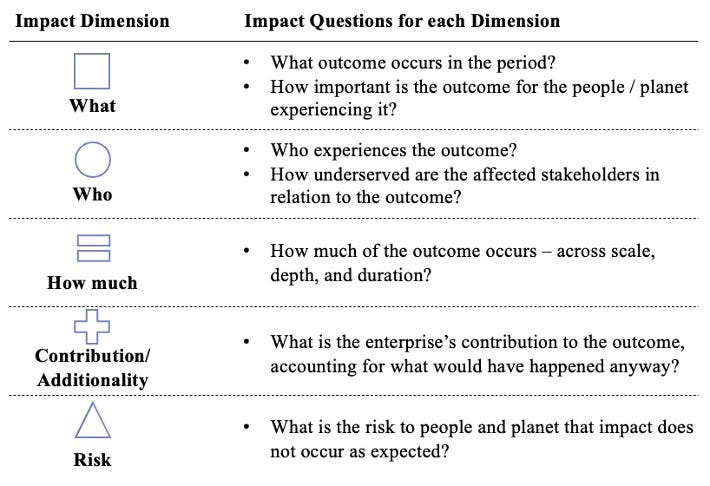

Kimpa follows the Impact Management Project framework, focusing on the What, Who, How Much, Contribution, and Risk of all deals (see picture below):

Source: own design based on Impact Management Platform

Moreover, Kimpa compares the impact of investments across asset classes (note from the author, August Solliv: this is the first time I hear about such a concept from an LP - this is worth digging more into). The way that Kimpa does it is that they choose one of the “gold standard” impact methodologies per asset class and score each asset class according to that methodology. Then to compensate for the difference in impact per asset class, Kimpa indexes the impact score – for example, impact VC fund investments are measured with the IMP and have a maximum score of 100. In contrast, public assets are measured with the Forest 500 methodology 🌳 and have a maximum impact score of 60.

Analyzing non-impact metrics of impact VC funds 📊

Kimpa’s key non-impact investment criteria are:

The team

The team and fund’s track record

The investment strategy (which growth perspective does the sector have, what are the macro risks in the geography the fund is targeting)

The level of "activeness" the fund will have in its investments

The fees (entry fees, management fees, carried interest, hurdle rate)

Why family offices stay discreet 🤫

Marie says that most families and family offices don’t disclose their fund investments as they wish to be discreet about the size of their wealth and not get contacted by every start-up and VC fund out there. This goes very much against the trend of corporates, the EIF, and some foundations who wish to show that they are supporting impact companies and are backing the transition 🌱

Marie notes, however, that fund managers rarely ask where the funds are from. She also believes that:

No matter where the capital stems from, you should take it and put it into impact - Marie Freville

However, Kimpa also does a lot of direct deals in impact start-ups. The founders of start-ups are in Marie’s experience much more diligent and curious about where the capital they receive stems from. This, however, also changes a lot in periods of economic downturn just as the one we are in now 📉 People become less wary about where the capital comes from and focus more on raising the capital needed 💰

Characteristics of family offices 🏠

Family offices are highly regionalized. Kimpa, for example, works mainly

Insert from author, August Solliv: This fits well with what I heard from Daniel Keiper-Knorr, Founding Partner of Speedinvest, on the EUVC podcast the other day. He said that even in their fund V, more than 50% of their LP base was from Austria 🇦🇹

Family offices are capital allocators just like larger institutional asset managers. They have to diversify their investments as well. Usually, the family offices that Marie works with put 10-15% of their capital in impact VC (which is equivalent to a couple of millions per year for the wealthiest families) 💼 The rest of their wealth goes to public equities, primarily focused on sustainability ♻️

Investing for impact or returns 💰

Marie says that the majority of her clients are not willing to sacrifice financial returns for impact. They are, however, usually committed to doing impact investments and had already started considering impact investing before working with Kimpa. Marie classifies the families and entrepreneurs she works within two categories:

Some families have strong values and theories of change, they are very attached to improving the sector in which their business has been active historically 🌱

Other families are more agnostic on the impact themes but are aware that climate tech is the next big thing in VC 🌍

Marie also highlights two counter-intuitive learnings she has had from working with family offices. Firstly, Marie sees that the older generations often struggle to transmit their values to the next generations. Building a family thesis and investing in impact projects is a way for them to do so 🤔 Secondly, the families Marie works with don't necessarily want to build an impact thesis that's linked directly to their company - they often see their investments as a chance to focus on other areas they care about 🎯

Moreover, Marie notes that her clients tend to prefer investing in direct deals. However, Kimpa advises family offices and high net-worth individuals to invest in funds to diversify, get access to a specific category of deals they could not invest in on their own (a specific maturity, geography), and invest in a specific category of start-ups that they are not experts in themselves 💼

Note from the author, August Solliv: as shown in the graph below, it is the vast majority of family offices globally that are invested in VC today.

Source: own design based on Goldman Sachs’ Eyes on the Horizon report

Impact debt vs impact equity investments ⚖️

Marie believes that being an impact investor is not only about doing impact VC investments. Family offices should instead construct a diversified strategy based on their impact objectives and their financial objectives. This often depends on the family’s situation, liquidity needs, and investment horizon 🕒

Marie highlights some advantages of impact private debt (at venture stage and later stage):

For the investors: it’s less risky than equity, interests are typically distributed earlier in the fund's life than capital gains in a venture capital fund, and the ability to drive the underlying company's ESG or impact policy by including covenants that can decrease or increase the interest rate charged based on reaching (or not) impact KPIs

For the underlying companies: loans are non-dilutive so the entrepreneurs prefer them, the start-up gets access to a source of capital that is not available with traditional banks (that are too risk adverse to lend to start-ups), and they can be advised on their impact strategy and have a true financial incentive to improve their impact metrics since attaining the indicators can lower the interest rate they're charged

- Marie Freville

Marie also highlights that impact venture debt is especially useful and necessary when building climatetech hardware. Hardware solutions require large amounts of capital and that capital risks completely diluting the equity base for the founders and investors if it doesn’t include debt.

An additional advantage of private debt at venture stage is that the European Investment Fund (EIF) gives a guarantee on parts of impact venture debt making the investment much more lucrative - Kimpa usually is on the lookout for these debt products.

How LPs look at other LPs 👀

Marie says it’s hard to give a general rule of how Kimpa thinks about other LPs, but here are some of her thoughts. Firstly, when a GP is backed by the EIF, it is a good stamp as the EIF usually does good due diligence on firms and invests where they see a market gap ✅

Secondly, Kimpa likes it when impact VCs are supported or backed by prominent non-profit or sustainability organizations as it usually ensures a strong focus on impact. An example that Marie gives (from the buyout space) is the regenerative agriculture fund between Tikehau Capital, AXA Climate, and Unilever (AXA Climate, 2023). BNP Paribas did something similar with their partnership with the Solar Impulse Foundation, utilizing key skills from both the investment and impact side to form the BNP Paribas Solar Impulse Venture Fund (Solar Impulse Foundation, 2021) 🤝

Conversely, at some point, Kimpa was looking at the Plastic Circularity Fund, which had the NGO, Alliance To End Plastic Waste as an advisor and LP. As Alliance To End Plastic Waste is primarily backed by large oil companies such as Total, ExxonMobil, and Shell (TotalEnergies, 2019), which decreased Kimpa’s interest in the fund. So existing LPs in a fund can have both positive and negative impacts on how a fellow LP looks at it.

If you want to learn more about Kimpa, you can read here.

Thanks for reading this week’s newsletter! Let me know what you think of this article and who else I should interview in this series - either in the comments section or in my DMs. Please subscribe to stay updated on articles about everything related to impact VC - and share with friends and colleagues. See you next week for another issue! 👋

Links to articles/data mentioned: