Impact methodology, measurement and KPIs, interview with Melina Sánchez Montañés 🎯

Impact Supporters Issue #20. Thanks for being here. If you have comments or feedback drop me a message.

Disclaimer from August Solliv: Everything that I write here is my own opinion and my own research, and is not affiliated with any current or former employments i.e. it’s my evening and weekend work 😉

Executive summary:

Interview with Melina Sánchez Montañés, Principal at AENU

AENU has a 6-part methodology on impact focused on intentionality, impact logic, interlock, impact scale, additionality, and impact measurement

Melina believes that climate VCs need a common methodology to help ecosystem players like LPs and start-ups navigate the VC world - she highlights the methodology of Project Frame

AENU focuses on outcome KPIs rather than output KPIs for their start-ups

AENU is thesis-driven, which Melina thinks is key to making the right venture bets in the climate space

AENU builds publicly available market maps in order to build thought leadership and help the rest of the impact VC ecosystem

Greetings, Impact Supporters! 🌍 It’s August Solliv 👋 Welcome to the next article in the series where I interview top impact VCs about specific impact topics! We will be diving deep into impact measurement, methodologies, and KPIs this week.

This week’s interviewee is Melina Sánchez Montañés, Principal at AENU, a climatetech VC firm. She is an expert in integrating impact in the VC model and shares some of her reflections 🌟 I hope you enjoy the read as much as I enjoyed the conversation!

Table of contents:

Melina Sánchez Montañés intro 👋

AENU intro 💼

Impact methodology 👨🔬

AENU’s excluded companies ⚔️

A common industry methodology 🤲

Setting the impact KPI 📏

Impact measurement at early-stage vs late-stage ⚖️

Direct impact vs enabling impact ⚗️

Projected vs realized impact + consequences 🤔

Impact deep-dive thesis-driven approach 🔍

Considerations about deep-dives 🤷♀️

Meet Melina Sánchez Montañés 👋

Melina is originally from Spain, but lives in Berlin today after spending 10 years in the USA. She started her career working for the Spanish and European governments, but then switched to a B2B SaaS start-up helping investors to optimize their performance 📈 She has since moved into Impact VC in Europe, Israel, and the USA. She has been with the AENU team since they launched the firm 2 years ago.

Meet AENU 💼

AENU is a climatetech VC fund based out of Berlin with €100m AUM. They were founded by Ferry and Fabian Heilemann, who are German serial entrepreneurs and brothers. Their first business, which they sold to Google for +€100m, was followed by launching Forto, a unicorn in the logistics space 🦄 Fabian was also a GP at Earlybird and built the climatetech practice there. AENU does Seed-Series A investments with €1-3m first ticket size. Fundamentally, they are climate generalist (i.e. they invest across verticals within climate). They invest in companies that can reduce 50Mt CO2eq emissions at the technology-level at scale, but also more largely companies focused on water, biodiveristy, and social impact 💧🌿🌏

Melina says that the three things that make AENU different are 🚀: 1. The entrepreneurial DNA. Most investors at AENU have founded or worked in start-ups. 2. Impact DNA. They have a top-notch impact methodology that they are respected for in the Impact VC community. 3. Impact deep-dive thesis-driven approach. Every 2-3 months, AENU takes a new topic and builds a thesis on the topic from the ground up. They talk to start-ups, corporates, and all other stakeholders in the value chain and create market maps that they share publicly.

What is your impact methodology? 👨🔬

At AENU, impact measurement is more than just measuring companies’ carbon footprint. They have 6 criteria they look at to see if a company fits their impact thesis and criteria 📊 See the picture below.

Source: AENU Impact Framework, 2023

AENU uses these criteria as the first step before they even start calculating the impact potential of an investment 🌟 For example, if a start-up doesn’t fit into the interlock criteria, then AENU excludes it from their investment scope even though it might have other interesting attributes.

The second step is then impact measurement and calculating bottom-up the potential impact that a start-up can have at the technology-level at scale.

What start-ups do you exclude that other investors might look at? ⚔️

Melina says that it all comes back to the 6 criteria that they have built their impact framework around 📋 She gives two examples of companies AENU wouldn’t invest in.

AENU wouldn’t invest in technologies that do predictive maintenance of leakage in oil and gas pipes. Those technologies can be argued to have a net positive effect as they avoid leakages, but Melina argues that it’s a lock-in technology as they enable oil and gas companies to still operate and reinforce the status quo.

Another example is in biotechnology. Some technologies have dual functions where they can produce new sustainable materials but also non-sustainable materials. At AENU, they don’t invest in this type of company either as there is no interlock between commercial success and impact ❌

Should there be a common impact measurement methodology? 🤲

AENU follows the methodology of the initiative called Project Frame. They supported the non-profit in the creation of this framework as they believed that climate VCs need a common framework to report on impact 🌐 Melina describes the Project Frame methodology as applying the TAM, SAM, SOM concepts to emissions.

Knowing that there is limited capital in the impact VC industry, Melina says that having a clear methodology enables her to ensure that their investments go to high impact potential solutions.

The advantages of having a common methodology are:

It helps LPs do due diligence on climate/impact funds as they can compare methodologies 🕵️♂️ (e.g. AENU supports their start-ups to do Lifecycle Assessments (LCAs) whereas other funds might take a more light approach). There is no right or wrong approach and it can depend on the size of the fund but at least it creates transparency and it allows LPs to compare apples to apples.

It supports the trend toward setting up an impact carry model in Impact VCs (see article on impact carry) 💼 Melina says that if you don’t have a common methodology, then it defies the purpose of aligning carry with impact as you can just set your own KPIs.

For start-ups, it can be confusing and chaotic without a common methodology 🤯 If the start-up has more than one impact investor with different methodologies then it duplicates work for the start-ups and takes time away from their core mission of building their impactful company.

How do you set your impact KPI? 📏

Melina says that often impact VCs follow the theory of change (see picture below). Investors therefore set up KPIs across activities, outputs, and outcomes. Many of the output KPIs are already measured by the impact start-up. Melina gives the example of a company installing EV (Electric Vehicle) charging infrastructure. They would most likely have an output KPI called “number of installed charge points for EVs“⚡ The outcome KPI is instead how many people switch to EVs from combustion engines thanks to the additional infrastructure.

Source: Allen, Cruz, and Warburton, 2017

However, early-stage companies rarely track their outcome KPIs. Then the impact VC has a conversation with the founder, often pre-investment, to make sure that they can align on an outcome KPI. Often impact VCs also have internal resources that enable them to support the start-up on setting and measuring the outcome KPI. And from there the impact VC tracks the impact KPI(s) over time ⏰

What’s the difference between impact measurement at early-stage and late-stage start-ups? ⚖️

The impact KPI and how hard it is to measure depends on multiple variables. For example, whether the start-up is early-stage or late-stage, whether it’s hardware/deeptech or software. The younger the company is, the less resources it has.

At Pre-Seed and Seed, an impact VC’s work is often focused on setting up the right processes inside the start-up to make sure that you can track the impact KPI in the future💡

At the later stages, impact start-ups have an ESG officer / impact officer and that person has often been reflecting on and defining impact KPIs 🌍

Software is often enabling companies so it might not be possible to calculate the attribution factor of how much it adds value to a value chain. Hardware companies often have a direct impact so it is usually possible to do an LCA to measure their impact. LCAs can even be done at the very early hardware technology development stages.

How do you adapt your impact methodology for direct impact companies and impact-enabling companies? ⚗️

AENU has divided companies into three categories. They can be found below.

Source: AENU Impact Framework

AENU’s position on how to measure the impact of enabling technologies has evolved. They used to think that they would use an attribution factor to estimate how much of the final outcome in an industry was related to a given impact-enabling start-up. However, AENU has concluded that there is too much uncertainty around the calculation for it to make sense, so they are using the more common approach of the industry today, which is to only measure the output of the impact-enabling start-up 🤔

Melina gives us an example of what this would look like for the same EV charging infrastructure company mentioned earlier. They would, therefore, track the number of installed charge points and how many kWh go through those charge points (i.e. output KPIs), but not go more in-depth about how the interfaces shift driving behaviors of consumers (i.e. outcome KPIs). EV charging infrastructure is part of the ecosystem enabling the transition, but it’s extremely hard to confidently estimate the outcome role it plays. Whereas some software solutions in other industries like cement have a much more direct impact. When using X software then the outcome in terms of the amount of materials reduced is Y 📉

Melina says that in reality there are many other sectors where it is not possible to estimate attribution, for example, in American politics. There are a lot of donations and lobbyism made to influence legislation through campaigns and direct discussions. It’s impossible to say which one campaign or discussion changed the legislation, however, all the efforts enabled it. Therefore, Melina has concluded that at the end of the day knowing that an enabling technology had some sort of effect is more important than calculating a very specific impact score.

What’s the difference between projected and realized impact? What consequences does it have if a start-up doesn’t meet its impact targets? 🤔

The projected impact calculations are based on a combination of 1. operational impact measurement data with 2. research data from conducting LCAs or other studies that give a unit impact number as well as 3. projections for where the company will be in 5-10 years. Melina says that it’s like doing a financial market size bottom-up.

Realized impact is tracked through the impact KPI that AENU decides with the company and can be updated through new LCAs and studies 📝

In most cases, start-ups fail to hit their impact targets because of a commercial issue. There is a low risk of mission drift because AENU only invests in start-ups where the financials and the impact of a start-up are interlocked. So Melina and AENU’s work is on finding out why the start-up is not succeeding commercially. Some of the reasons that Melina gave are that the start-up has a failing go-to-market approach, that the start-up has to redesign their product, or that the start-up is building something deeptech that ended up taking longer to build than expected. So the consequences of a start-up failing to hit its impact KPIs are the launch of discussions about how to get back on track commercially 💬

Tell us more about your impact deep-dive thesis-driven approach 🔍

Melina says that there are two approaches in VC generally. Either an investor is opportunistic or thesis-driven (or a combination). Melina believes in doing deep-dives and thereby being thesis-driven as climatetech is such a vast space with limited track record of historical investing (after cleantech 1.0). Melina says that as a climate VC, she prefers to understand the solutions that are needed and the commercial potential rather than scratching the surface on all topics opportunistically 📚 She, however, also admits that as a very early-stage investor, it might not make sense to always do deep-dives as at that stage you invest more in the founders than the idea.

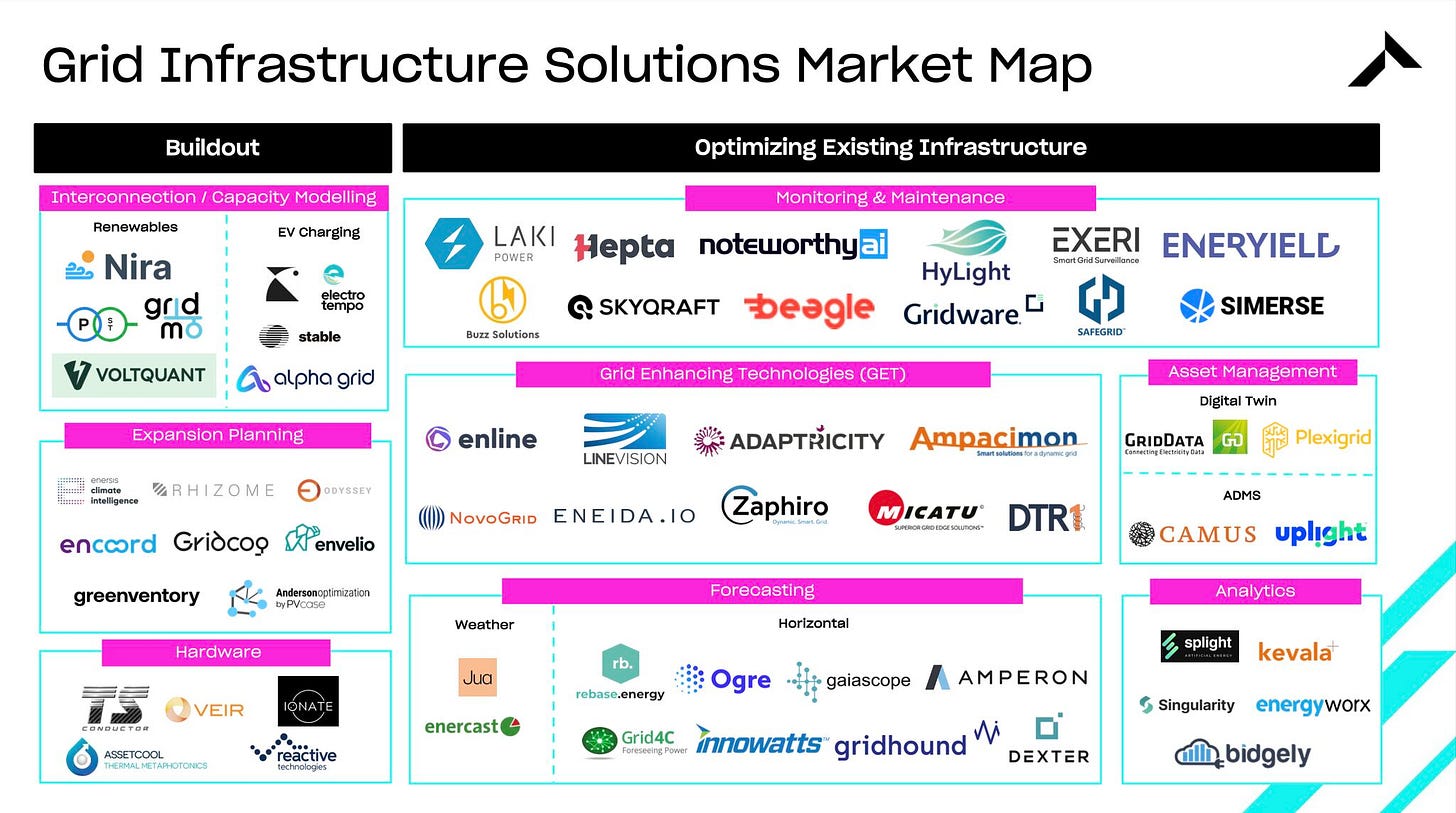

Here is an example of one of AENU’s market maps that they share publicly:

Source: AENU on LinkedIn, 2023 and you can find their full deep-dive here

Whenever diving into a new topic, AENU spends 3-4 months on it and talks with a lot of people in the ecosystem, which also helps them down the road for due diligence on potential investments. They then publish the deep-dives and market maps publicly. Some of the last deep-dives they have made are on sustainable logistics and grid infrastructure 🚛🔌

The deep-dives are now part of AENU’s brand and also create value for the rest of the climate VC ecosystem.

What considerations do you have with your deep-dive approach? 🤷♀️

Melina says that it is very much a win-win situation for them and the ecosystem. The major caveat is, however, the time it takes to create the deep-dives ⏳

Melina also highlights that the deep-dives are not exhaustive and more hours could be spent on them but they give a very solid understanding of some segments in climate.

Lastly, the industry is moving so fast that AENU has to be good at timing the deep-dives so that they cover the right verticals at the right time and don’t miss out on other opportunities.

Thanks for reading this week’s newsletter! Let me know what you think of this article and who else I should interview in this series - either in the comments section or in my DMs. Please subscribe to stay updated on articles about everything related to impact VC - and share with friends and colleagues. See you next week for another issue! 👋

Links to articles/data mentioned: