🏭 Investing in hardware businesses as an impact VC

Impact Supporters Issue #9. Thanks for being here. If you have comments or feedback drop me a message.

Disclaimer from August Solliv: Everything that I write here is my own opinion and my own research, and is not affiliated with any current or former employments i.e. it’s my evening and weekend work 😉

Software alone will never solve the climate crisis - Tove Larsson (Pratty, 2022a)

Hey all, it’s August Solliv 👋 This week we will deep-dive into hardware and CAPEX businesses and how impact VCs can support CAPEX-intensive businesses. This article will discuss the below topics:

Hardware is needed to create impact (both climate and social impact)

Why is it hard to do hardware VC investments?

What are the advantages of hardware VC investments? How should impact hardware investments be done?

Status on hardware investments today

How can you finance hardware?

Hardware returns and exits

Case: The challenge of building first-of-a-kind (FOAK) production plants

Hardware is needed to create impact (both climate and social impact) 🍀

VCs have traditionally chosen to only invest in software companies as these fit the scalability model that VCs look for the best. Nevertheless, as quoted above, software alone will never solve the climate crisis. Digitization, data analysis, and data gathering with software solutions are surely needed, but the reality is that physical products and the physical environment need to change as well to create a more green and just world (Verve Ventures, 2022). We need to rethink how we produce and build in industries like agriculture, logistics, construction, transportation, carbon capture, energy, etc. so that these industries both become resource-efficient and just (VentureBeat, 2018; Pratty, 2022). The type of hardware investments needed can be robotics, spacetech, sensors for data aggregation, new production plants and much more. These can all replace old inefficient, polluting and injusting ways of production. Dörte Roloff argues that hardware and manufacturing startups are especially relevant for the green economy, as many ecological challenges require sustainable solutions for industrial production, machinery, and hardware (Bumb, 2023). It is definitely key in the environmental transition, but it is also key for social impact start-ups for products such as medical equipment, edtech solutions, mental health solutions, and many more. The real truth is that these solutions can have transformational impact (contrary to the incremental impact of some software solutions) but this requires achieving scale that many solutions don’t get to today (Ellis, 2023) 🤯

An inherent counter-intuitive situation with hardware investments is, however, that they have a natural negative impact that software solutions don’t have due to the resources needed to produce the products. As investors, you need to ensure the product has net positive impact even though it requires resources to be built - and this, therefore, requires changing the way that investors evaluate the impact of their start-ups (Fredrik Hånell in EIT Urban Mobility, 2022) ⚖️

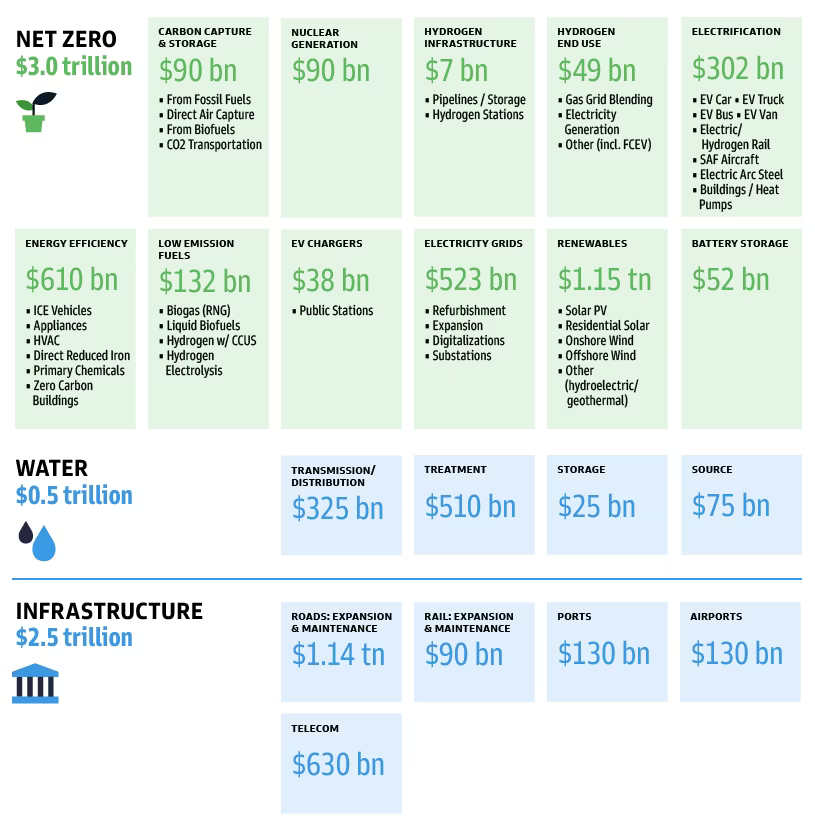

Here is a non-exhaustive list and size of the solutions needed to solve green CAPEX issues:

Source: Goldman Sachs, 2022

Why is it hard to do hardware VC investments? 🥊

Software companies have lower capital requirements, higher margins, more rapid growth potential compared to hardware companies. Those are the reasons why VCs and impact VCs have long favored software solutions (Tech, 2014; Dealroom, 2023; Cote, 2023). This difference has happened in the last 30 years. “Since the late 1990s, the cost of starting a software company has dropped while access to capital has risen. Unfortunately, there has not been a similar cost reduction for hardware and industrial solutions, creating a funding gap” (Techstars, 2020). Nothing has reduced the cost of hardware as much as open source and AWS did for software and therefore investors see a lower return potential with hardware solutions. The reality today is that traditional manufacturing is still faster and cheaper for high volumes than new technologies like 3D-printing even though 3D-printing allows to free employees and construct more flexibly in smaller quantities (Techstars, 2020) 🏭

Moreover, there is a fear that hardware solutions will take too long to build and that returns will not be able to match those of software companies. This is partly pushed by the very negative results of the Green tech bubble in 2008-2009 but also the reality that the time horizon for hardware start-up is longer (it can be more than 5, 7 or 10 years) and they, therefore, have to make up for that time by growing even faster than software solutions (Tech, 2014; Nick de la Forge in EUVC, 2023). The longer development times are due to a complex initial development phase and longer time-to-market ⏳

The last disadvantage of hardware is its higher technology risk. Hardware and deeptech start-ups build transformative and novel tech that has not yet been proven in the market nor at scale (Dealroom, 203). As Verve puts it “The question is not just “Will it sell?”, but also “Will it work?”” (Verve Ventures, 2022). So hardware start-ups need to prove that they can mix high scientific and technological knowledge with high commercial knowledge and succeed on both parameters at once. The technological component does not only make the investment more risky, it also adds complexity to the deals that traditional and impact VC investors are not always the best suited to understand and analyze. Traditionally VC firms hired finance and entrepreneurship experts in their investment teams, but not technical experts. This means that deep hardware tech for impact is less understood by VC investors 🤔

What are the advantages of hardware VC investments? How should impact hardware investments be done? 🙌

Even though, most VCs avoid hardware deals, that doesn’t mean that they don’t have some advantages.

Firstly, hardware-based start-ups have lower demand/go-to-market risk. If you get the tech right and are able to bring the solution to the market, buyers will pull it out of your hands as it is novel, with high impact, and you can produce it at scale (Pratty, 2022b). An example used by (Pratty, 2022b) is the battery start-up Northvolt. The battery demand from planned EV production in Europe is more than 5x the volume of confirmed projects in Europe 2040 so if you manage to build a greener battery at scale, then the demand is there immediately. When these hardware start-ups reach scale they can get to commercial viability quicker than some software solutions as they have to invest less in customer acquisition. And they can fund themselves through the growth stage without external capital injection thanks to their commercialization (Hang, 2015) 💸

Secondly, there is lower competition for hardware deals. The deep hardware tech market is much less crowded from an investor point of view than SaaS. So initial valuations of startups tend to be attractive and less prone to excessive valuations driven by many VCs chasing the startups with the highest growth (Verve Ventures, 2022). An this is in spite of hardware outcomes being fairly similar to software outcomes. The survival rate for hardware startups is about 77% compared to about 84% for software and in the long term returns are similar. For the gap in survival rate, one notable pattern is that a lot of successful hardware companies ship products in the first few years so competition should be higher for these. (Abrahamson, 2023).

Thirdly, there are higher barriers to entry in the markets where hardware start-ups operate as each start-up has higher defensibility (Larsson, 2022). Hardware start-ups require more capital investments upfront and build facilities and patented solutions so less competitive alternatives exist. Even if a competitor invested a lot of capital, patents would stop them from creating copycats. The competition is completely different for software solutions. Software startups often rely on network effects and market dominance as the main hedge against new competitors, but for hardware companies it is the quality of the technology (Dealroom, 2023). It makes sense. If something is relatively easy to get off the ground, others can also get it off the ground quickly

So to make good impact hardware solutions, they need to solve a large societal issue that software cannot tackle as it is related to the physical environment, and play in a field where high technological differentiation is key as it will create high barriers to entry while having low demand risk.

Status on hardware investments today 📋

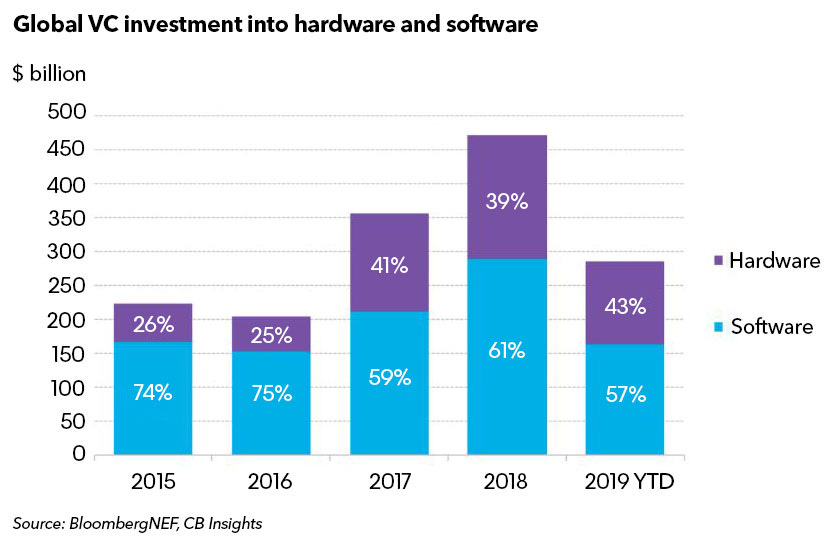

A graph from 2019 shows the general split between software and hardware investments in VC globally.

Source: BloombergNEF, 2019

Since 2019, early-stage investment activity in impact hardware has been increasing as well and even in the current downwards trend, hardware start-ups have been doing well (Bullard, 2022). Many of these companies are deeptech start-ups as more deeptech start-ups produce hardware components in their solutions (60% of them includes hardware whereas only 20% of general start-ups include hardware, Dealroom, 2024). These are, however, not all impact start-ups.

Looking at climatetech specifically, the split looks different with only 30% of VC investments being spent on hardware solutions and 30% on solutions that either mix software and hardware or uses none of these.

Source: Net Zero Insights, 2022

Some of the investors in hardware solutions have adapted the VC model in order to support hardware start-ups. This can be accepting higher technological risk or having more patient capital with longer holding periods (Innovation Centre Denmark, 2021)

How can you finance hardware? 💰

Financing the hardware components as an impact hardware start-up is the key to success. The machinery is not usually financed by equity investments from the VC investors, but it is rather often financed through debt capital from financial institutions so that it affects the potential for returns as little as possible (Bumb, 2023). The issue is that traditional project finance that would be used for these kind of hardware investments prefer to invest in widely adopted solutions and not you and small solutions (Khatcherian & Kearney, 2022). Derisking of early impact hardware solutions is, therefore, also provided by grants, philantropic capital, and venture debt. Donations to mitigate climate change has for example doubled over the last five years to 5-9 billion USD and is part of pushing some of the transformational climate change innovation that we see on the market (Innovation Centre Denmark, 2021). VC investors must however also come to the realization that not all climatetech solutions are VC plays. Some are simply too capital-intensive and require infrastructure private equity type of investment sizes and return expectations (Antler, 2022) 🏗️

An overview of the sources of financing for hardware and the expected returns can be found below:

Source: CTVC, 2021

Hardware returns and exits 📈

Hardware giants have been acquiring innovative startups when those larger companies aren’t able to invent something in-house, which makes hardware startups a good investment (VentureBeat, 2018)

Hardware start-ups (impact and traditional) have unique exit opportunities. The most active acquirers are tech US companies, led by Apple and Meta, but also Snap, Microsoft, Google, Intel and Qualcomm. The European Deep Tech saw an unprecedented nearly $100B in exit value in 2021 (Dealroom, 2023).

Moreover, the market is evolving to offer more early exit opportunities for early-stage hardware VC investors. Hardware VC investments are usually capital intensive and long-term and it is, therefore, key that early-stage VC investors can exit their investments along the development of the solution through secondaries or SPACs (Larsson, 2022).

Believe it or not, these favorable conditions actually mean that there are a lot of succesful hardware start-ups out there, that have been VC-backed - both impact hardware start-ups and traditional hardware start-ups. A couple of the famous hardware climate start-ups are Einride, Sunrun, Northvolt, and Climeworks. A couple of the famous social impact hardware start-ups are OrCam MyEye, Azuri Technologies, and CMR Surgical 📈

According to dealroom projections, over the next five years, 60% of revenue in “Technology” will come from Hardware, with only 40% coming from software. And this is even though only 20% of VC funding has been going into hardware start-ups in the last years (Dealroom, 2023).

Case: The challenge of building first-of-a-kind (FOAK) production plants 🏭

I do believe that some of the best returns in climate tech will come from these FOAK Hardware companies. You just have to be very selective and really back people that understand the real world - Irena Spazzapan on MCJ, 2023

A challenge for some impact hardware start-ups is that they are so innovative, that they have to build first-of-a-kind (FOAK) production plants. These are plants where products or formulas that might only have existed in theory or in very small doses can be produced before truly scaling up to meet commercial demand. They are, therefore, crucial to prove the viability of the business model of the start-up (Extantia Capital, 2020). They add an extra layer of risk and complexity for impact VC investors. “FOAK funding is hard to come by because the checks are too large and returns too low for VCs, while the risk is too high for project finance investors and banks, which prefer proven tech and predictable revenue streams” (Ellis, 2023). Currently, the estimate for the funding fap for FOAK plants is approximately $150-190 billion (Etechmonkey, 2022) 🏦

The issue with financing FOAK plants is that the company is going to take 3-5 years before they have commercial agreements, let alone revenue, so the risk is high and the payback is far away. Therefore, start-ups seeking to build FOAK plants must find various sources of financing to invest in the FOAK plant (see picture below for examples), and build the plant early in their funding journey, as most Series B growth investors want to avoid technological risk and want the start-ups they invest in to have started generating revenue (Abrahamson, 2023). To be able to finance FOAK plants, start-up founders have to plan out every detail of the plant to be able to raise debt, and can divide the plant up in smaller projects that are easily investable for various financiers (Climentum Capital, 2023).

Source: Climentum Capital, 2023

The advantage of FOAK plants is, however, that if a start-up manages to get it funded and proves the value of its product and scalability potential, then its valuation takes a strong jump as the technological and scalability risks are then low, and the demand risk is lowed as explained earlier in the article. New buyers such as Private Equity infrastructure funds and large corporates can invest in start-ups once the FOAK-risk disappears and this pushes the valuations sky-high (Climentum Capital, 2023) 📈

Source: Extantia Capital, 2020

To conclude, some impact VCs must invest in impact hardware start-ups in order to unlock a part of the impact that cannot be achieved otherwise. The impact VCs must, however, be wary about when they enter these start-ups and at what risk level they enter. Hardware start-ups have, though, also proven to be able to achieve interesting returns - but there are bad apples among the good ones - just like in any industry.

Thanks for reading this week’s newsletter! Let me know what you think of this article - either in the comments section or in my DMs. Please subscribe to stay updated on articles about everything related to impact VC - and share with friends and colleagues. See you next week for another issue! 👋

Links to articles mentioned:

An extra article interesting on the software enabling hardware investments: https://sifted.eu/articles/climate-tech-software-planet