Investing in hardware, interview with Christian zu Jeddeloh 🛠️

Impact Supporters Issue #29. Thanks for being here. If you have comments or feedback drop me a message.

Disclaimer from August Solliv: The views expressed are solely my own i.e. it’s my Sunday fun work 😉

Key insights:

Interview with Christian zu Jeddeloh, an associate at Norrsken VC and co-author of The Climate Hardware Playbook

The largest challenge of climate hardware is scaling

Norrsken VC divides start-up risks into three parts: market, scale-up, and tech risk. Hardware start-ups primarily have tech and scale-up risk, not market risk

Norrsken VC’s goal is to prove that you can achieve market returns as an impact VC - investing in both social and environmental impact start-ups, and while investing partly in hardware

On the one hand, hardware start-ups have higher defensibility and stickier customer relationships. On the other hand, they have complex capital needs and have a multiple disadvantages compared to software start-ups.

Some types of deeptech hardware fit better with alternative VC models, with longer fund lifetime for example

Greetings, Impact Supporters! 🌍 It’s August Solliv 👋 You are now 2000+ reading along every week - I’m happy that you like what I write 😃 Here is what we discussed with the hardware investing expert, Christian (≈9 min reading time):

Hardware is hard 😖

Advantages of hardware 🏅

Risks in hardware investments explained 🥶

Why scaling is hard 🤯

Working with tech risk 🤖

If cleantech 1.0 failed, why should it work today? 🤔

Change the VC model to support impact start-ups 🫵

Unanswered points in hardware ❓

Meet Christian zu Jeddeloh 👋

Christian has been an investor for 3 years. He has a background in finance and previously worked in the biotech start-up, Atai Life Sciences 🧬 - a platform acquiring and incubating promising therapies for mental health disorders. At Atai, he worked with investments in the venture management team getting a mix of the start-up and VC life. Christian joined Norrsken VC 1,5 years ago and is an Associate today.

Meet Norrsken VC 💼

Norrsken VC is an impact-focused VC fund investing in entrepreneurs that solve the world's biggest problems, focusing on Seed to Series A rounds in Europe. The fund has a strong footprint in climate tech but also invests across healthcare and social impact 🪢 They do both software (SW) and hardware (HW) investments. The goal with the fund is to show that you can make market returns by investing in impact companies only, and thereby drive more capital into the sector 🙌

Meet Climate Hardware Playbook 📘

Christian is the co-author of Climate Hardware Playbook, a collaboration between Norrsken VC, Speedinvest, and Planet A, a guide explaining how HW fits with the impact VC model 📘 The Playbook was made as all 3 VC firms had the conclusion that it was quite clear for most investors how SW works, what metrics to look at, and how to analyze it, but that it was not as clear with early-stage HW investing 🔍 It is split into 9 categories:

1. Technology & Product, 2. Team, 3. Business Model, 4. Capital Stack, 5. Sales & Go-To-Market, 6. IP & Patents, 7. Operations, 8. Navigating Policy and 9. Impact Assessment.

The playbook is based on surveys with 118 investors and 142 start-ups 📋, and 30+ interviews. The playbook should be read as introductions to all topics with information about the topic, expectations from investors on the topic, comments from founders, and links to additional research. Find the link to the playbook in the sources at the end of the article.

Hardware is hard 😖

From applying for permits to managing supply chains and securing feedstocks - running the operations of a hardware startup is unarguably more complex than running a B2B SaaS company. - Climate Hardware Playbook

Investing in hardware adds complexity 😯 However, most climatetech VCs have also realized by now that if you want to do climate, you have to do hardware. We cannot abate the world’s GHG emissions without HW. The majority of investors that Christian and the team interviewed said that the interest in HW has increased in just the last 12-24 months. There is a momentum pushing toward HW 👉

However, Christian says that a lot of generalist VCs face the problem that they, historically, made their money on SW so their ICs have a hard time transitioning towards understanding and believing in HW.

Main advantages of HW 🏅

Climate HW also has some clear advantages. The main ones according to Christian are:

Climatetech HW has more technologically advanced products, which increases defensibility and entry hurdles thanks to intellectual property ™️

Climatetech HW has sticky customer relationships 📎

Climatetech is pushed by strong macro-trends of e.g. decarbonization that increases demand and increases access to subsidies ☘️

To Christian, HW doesn’t come in opposition to SW. There are a lot of great SaaS climatetech solutions that have real impact. SW is just not enough for the current climate transition.

Explaining start-up risk in hardware 🥶

Norrsken divides impact start-up investment risk into three:

Scale-up risk: Does the process work at scale with good unit economics?

Tech risk: Is there new tech that needs to be developed? Can it work?

Market risk: Will customers buy the product?

When investing in climatetech HW, Norrskens accepts having scale-up and tech risks that are higher than for SW, but they do not take market risks 👎 They believe that if climatetech HW is produced at scale at market price then it will be bought. Often climatetech HW start-ups produce products that are already in the market at the same price but with less climate impact 🙏 Christian mentions Northvolt as an example. Their batteries were in such high demand that they just needed to produce and not think about selling. A classic B2B SaaS has more commercial market risk as it is unsure whether there are customers for it 😶

Scaling hardware is hard 🤯

To Christian, the largest challenge/risk with hardware is scaling. That is split in three parts: 1. Fundraising, 2. Sales, and 3. Team.

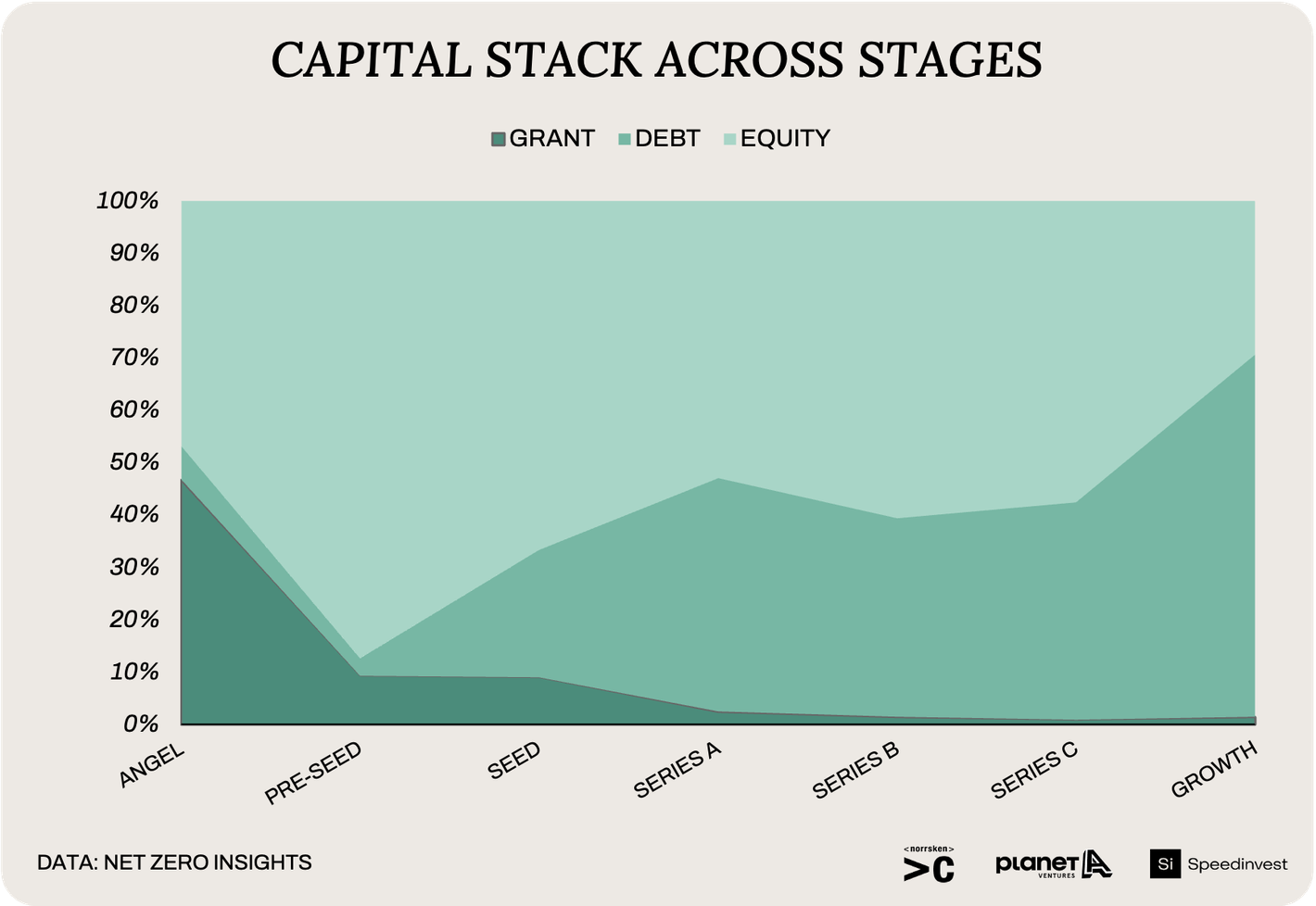

Christian sees fundraising as a challenge as VC funding is usually not enough in itself. Climate HW is usually about producing materials/resources at scale, and you often have to get financed by project financers, infrastructure investors, debt providers, grantmakers, etc. on top of VC investors. Moreover, hardware start-ups sometimes need large fundraising very early in their development when they are for example building a First-of-a-kind (FOAK) plant 👨🏭

Source: The Climate Hardware Playbook, 2024

Christian frames reaching sales scale as a chicken and egg problem. Investors want to see sales traction and customers want to see scale and a good product before buying - that goes for any type of tech. In hardware, it’s harder as you often build solutions with limited unit economics until you reach a certain scale.

Christian believes that the team is always the most important in early-stage start-ups. It is even more so in climatetech as the founders need to navigate complicated contract terms, negotiate large deals in a nontransparent environment, and develop expertise in complex scientific topics.

Tech risk: How do you work with Technology Readiness Levels in HW? 🤖

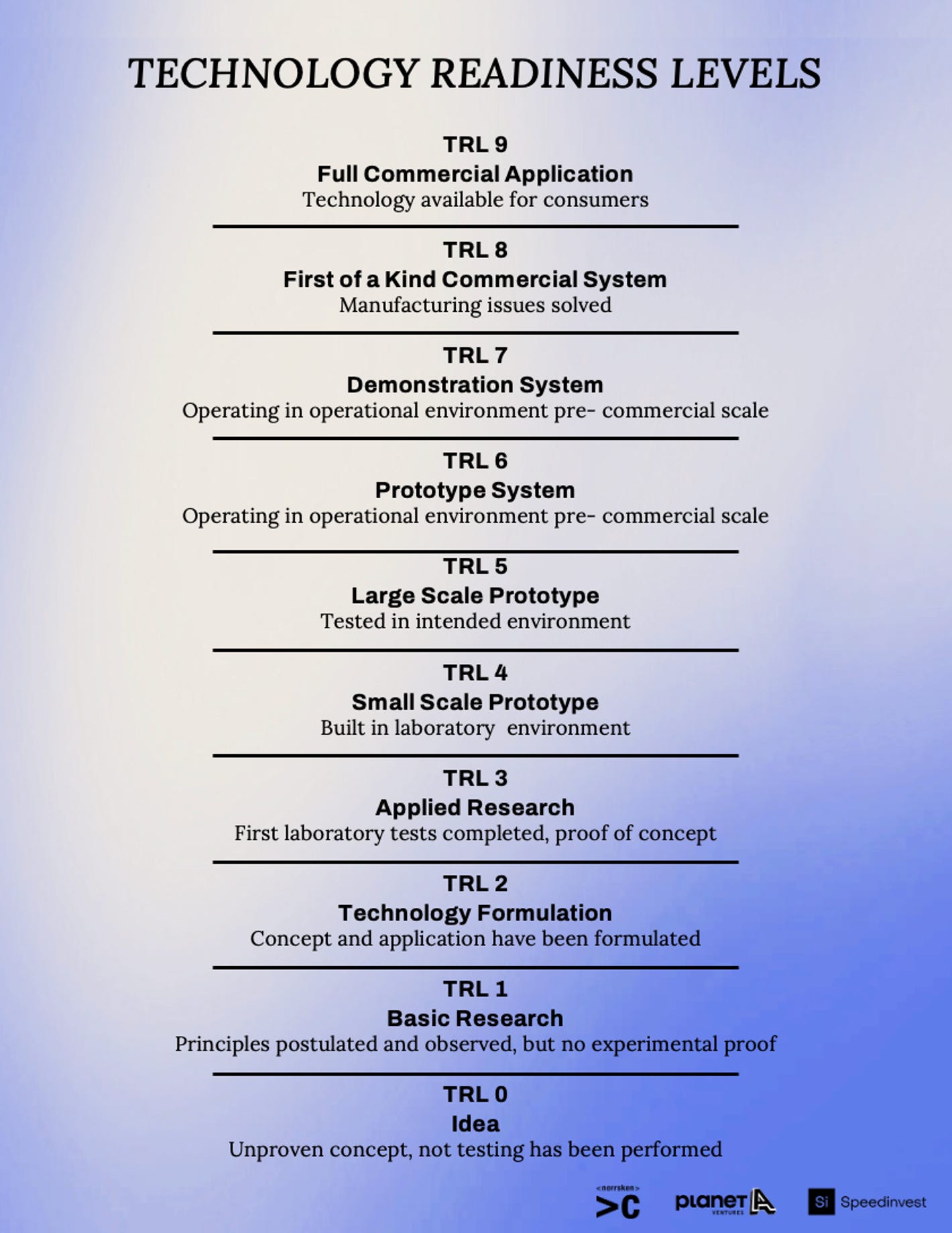

Technology Readiness Levels (TRL) should be used to assess a start-ups tech risk. At Norrsken, they look at deals at TRL 5+. This gives them two advantages: 1. It allows them to believe that the start-up they invest in might reach TRL level 9 within the 10-year time horizon of their fund and can thereby reach hyperscale. 2. It means that they don’t need the extended scientific expertise that it would require to assess earlier stage technological risk 💻 See an overview of TRLs below:

Source: The Climate Hardware Playbook, 2024

To settle on the TRL level of the start-up, Norrsken usually asks the start-up first how they assess themselves, then look at the start-up’s data, and, if needed, engage external advisors. And either way Christian says that:

Good founders are very transparent about their TRLs

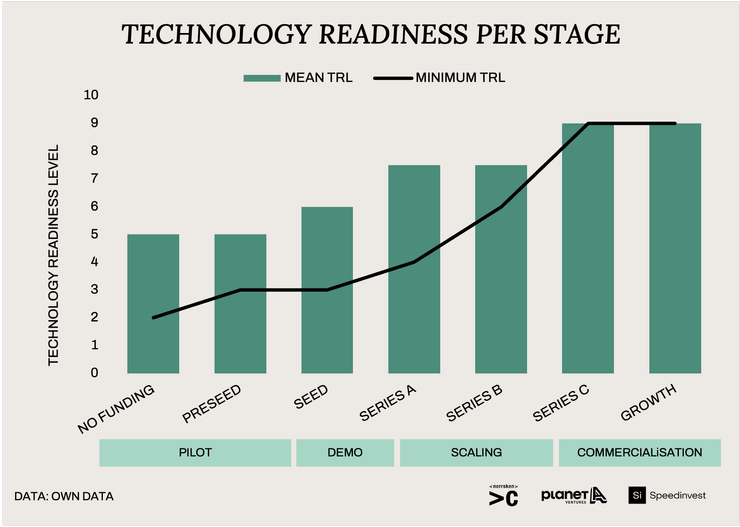

In the Climate Hardware Playbook, Christian and the team give a view on what TRLs correspond to various investment stages.

Our survey suggests that preseed/seed funds would feel comfortable with a TRL of 2-3 whereas Series A investors would want to see a minimum TRL of 5. Later-stage investors would want to see de-risked technology and demonstrated unit economics and would only invest at TRL 9.

Source: The Climate Hardware Playbook, 2024

If cleantech 1.0 failed, why should it work today? 🤔

We will see a lot of start-ups failing. - Christian zu Jeddeloh

All solutions will not work in parallel. However, some things make Christian and Norrsken believe in the market.

Underlying conditions are different. The world has succeeded in building a green energy system that is price-comparable 🔋 Just take a look at battery and solar prices that have declined heavily since cleantech 1.0 (Our World in Data, 2021).

Big investor demand 💰 There is a demand for investing in climate solutions from large asset managers as well. That didn’t exist as much in cleantech 1.0 (Impact Investor, 2024).

More corporate awareness 🗣️ Christian says that Norrsken did a deep-dive on cement some months ago, and all interviewees said decarbonization was the largest trend in the industry.

Regulation 🏛️ It can change with the next election, but for now, there is much more regulatory pressure than 15 years ago.

Do you need to change the VC model to fit HW climatetech? 🫵

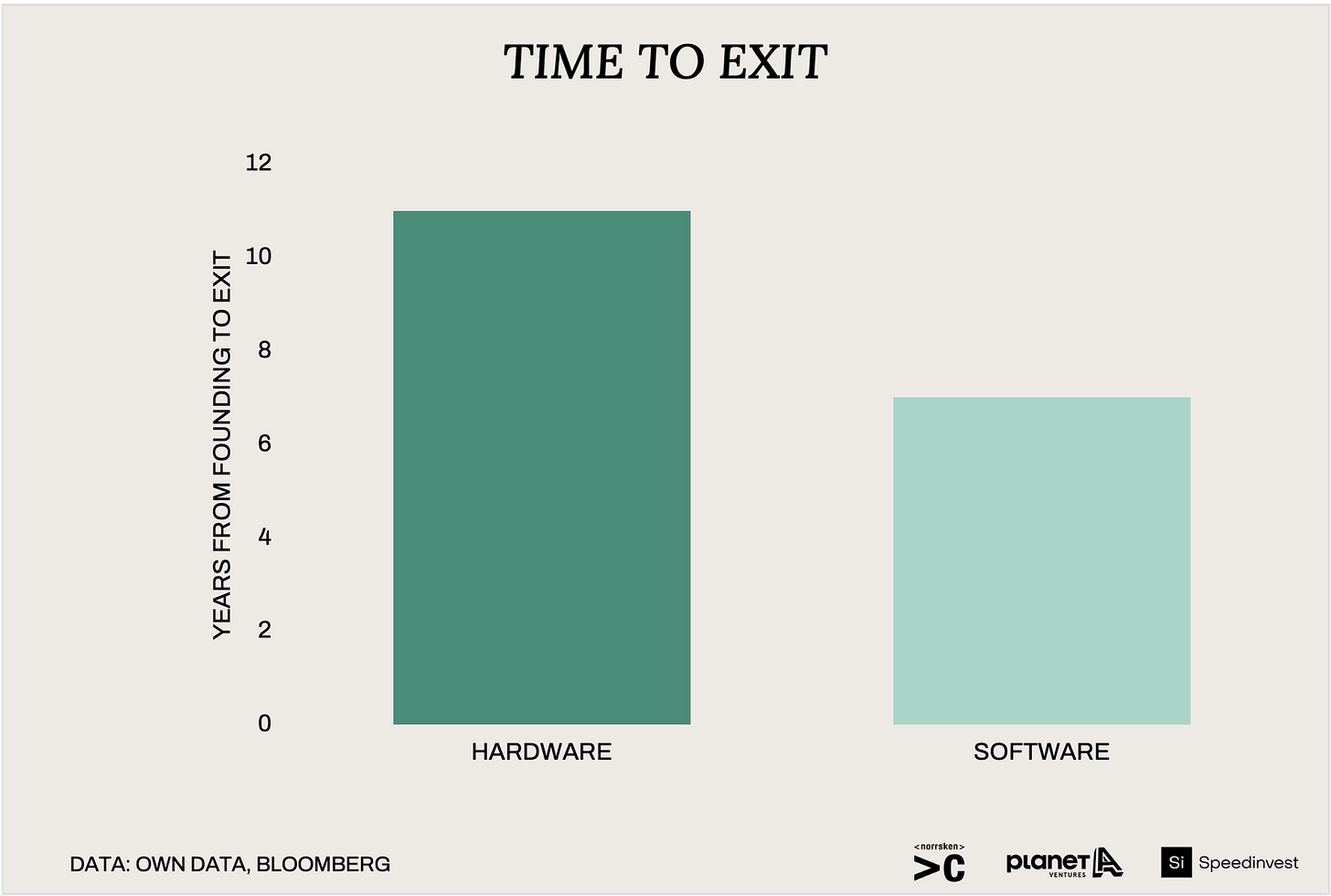

HW climatetech is different from typical B2B SaaS. From a VC fund model perspective, the major change that Christian sees is on the time horizon. Some HW deeptech innovation can fit in the classic timeframe but some also take longer to scale. To offer patient capital, requires adapting the classic 10+2 VC fund model.

Source: The Climate Hardware Playbook, 2024

In the market, Christian has seen some VC firms trying out evergreen funds (e.g. Kiko Ventures [added by the author, August Solliv - Forbes, 2022), and firms try out 15-year funds. Time will show how they’ll perform ⏳ Ultimately, it depends on the flexibility of LPs. When you make longer time horizons it also means less liquidity for LPs so they have to be on board with longer time horizons.

However, Christian makes a good thought experiment. If a VC fund had invested in Tesla in 2005 and had owned a 17-year fund or an evergreen fund, they could have cashed out in 2022 at a trillion-dollar valuation. So for some start-ups patient capital does make sense.

What open questions do you still have after building Climate Hardware Playbook❓

Climate HW investing is not a topic that you just crack. - Christian zu Jeddeloh

So there are many open questions left 👐 Two examples are:

What does the ideal capital stack look like for climate HW?

Will we be able to solve the scaling of manufacturing this time around when we didn’t in cleantech 1.0?

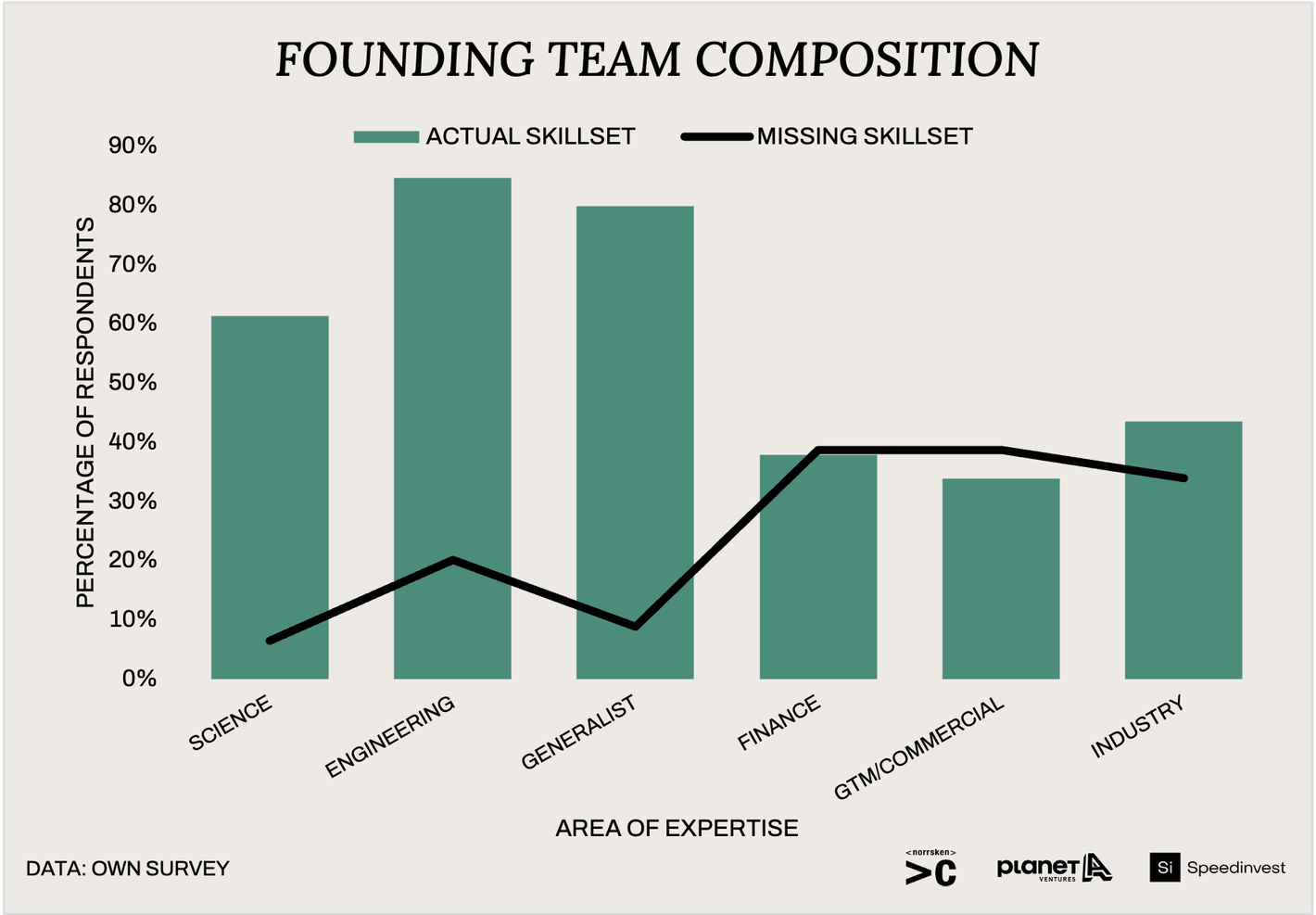

However, Christian also says that in the end, in early-stage investing, it will always be about the team - whether it’s HW or SW. Christian gives the example of Northvolt. Northvolt’s founders did something that everybody thought was impossible. They 1. accessed infrastructure financing very early in their development and 2. got potential suppliers and buyers to invest in them very early. Exceptional teams will find a way to grind through the hardest challenges 🚀 And in HW, they need strong scientific and engineering capabilities, on top of more traditional entrepreneurial capabilities like entrepreneurial spirit, finance, commercial, and industry expertise. See the graph of how HW founders perform on these capabilities today:

Source: The Climate Hardware Playbook, 2024

Thanks for reading this week’s newsletter! Let me know what you think of this article and who else I should interview in this series - either in the comments section or in my DMs. Please subscribe to stay updated on articles about everything related to impact VC - and share with friends and colleagues. See you next week for another issue! 👋

Links to articles/data mentioned: