💵🍀 Let's talk about impact carry

You are reading Issue #7. Thanks for being here. If you have comments or feedback drop me a message.

Disclaimer: Everything that I write here is my own opinion and my own research, and is not affiliated with any current or former employments.

I don’t believe that fund managers should be able to say they’re impact investors unless their fund compensation is linked directly to their impact - Aunnie Patton Power at GIIN Investor Forum, 2022 (Power, 2022)

Impact-linked carried interest (commonly referred to as impact carry) is the most discussed tool to ensure that impact VCs align their strategy and investments with their impact. This article will discuss the below topics:

Definition

Impact fidelity

Implementation

Challenges & Discussions

Definition 📖

As most of you know, carried interest (i.e. carry) is the way fund managers are compensated for making good returns on the fund by receiving a percentage of the profits generated by a fund (typically 20%) after the LPs have received their minimum amount of money back (i.e. above the hurdle rate). The goal of the carry is to align interests between GPs and LPs so that everybody is aiming to achieve the highest returns possible (Panchal & Bourke, 2022). Impact carry is a tool used by impact VCs and means that only a part of the carry is paid out if the impact KPIs are not met as well as the financial goals. The goal is to avoid conflicts of interest between mission-based impact and financial performance because the VC’s return is tied to both (Ananda, 2021) ✅

Impact carry is not a new concept 🕰️ “The GIIN issued a brief on impact-based incentive structures back in 2011, and the Stanford Social Innovation Review published a piece by Daniel Izzo about linking compensation to impact in 2013“ (Power, 2022). In the EU venture space, the European Investment Fund (EIF) began to introduce impact measurement in 2013 and impact carry in 2014 (Ananda, 2021; Meek, 2022).

Impact fidelity 👮♂️

All GPs have a fiduciary duty as they have to maximize their LPs’ returns. Impact VCs also have a duty to ensure that they meet their impact goals. Thirion et al. (2022) coined the term “impact fidelity“ to describe that duty. If impact VCs don’t integrate their impact fidelity into their fund construction, they risk mission-misalignment 💔

While impact fund managers have other incentives to pursue the impact goals of their funds (including their own consciences, their reputations, the requirements of their investors, and the regulatory risk inherent in making false representations to investors), proponents of impact carry argue that impact fund managers should also have a financial incentive to pursue impact through their investments - Panchal & Bourke, 2022

One way, to achieve impact fidelity is by introducing an impact carry structure in your fund as you incentivize the VC firm to reach impact and returns simultaneously. This is the major tool discussed in the field and is pushed amongst others by LPs. Other tools are impact bonuses and having an impact board supervising the work of the VC (Power, 2023; Lin, 2022).

How to implement impact carry 🖊️

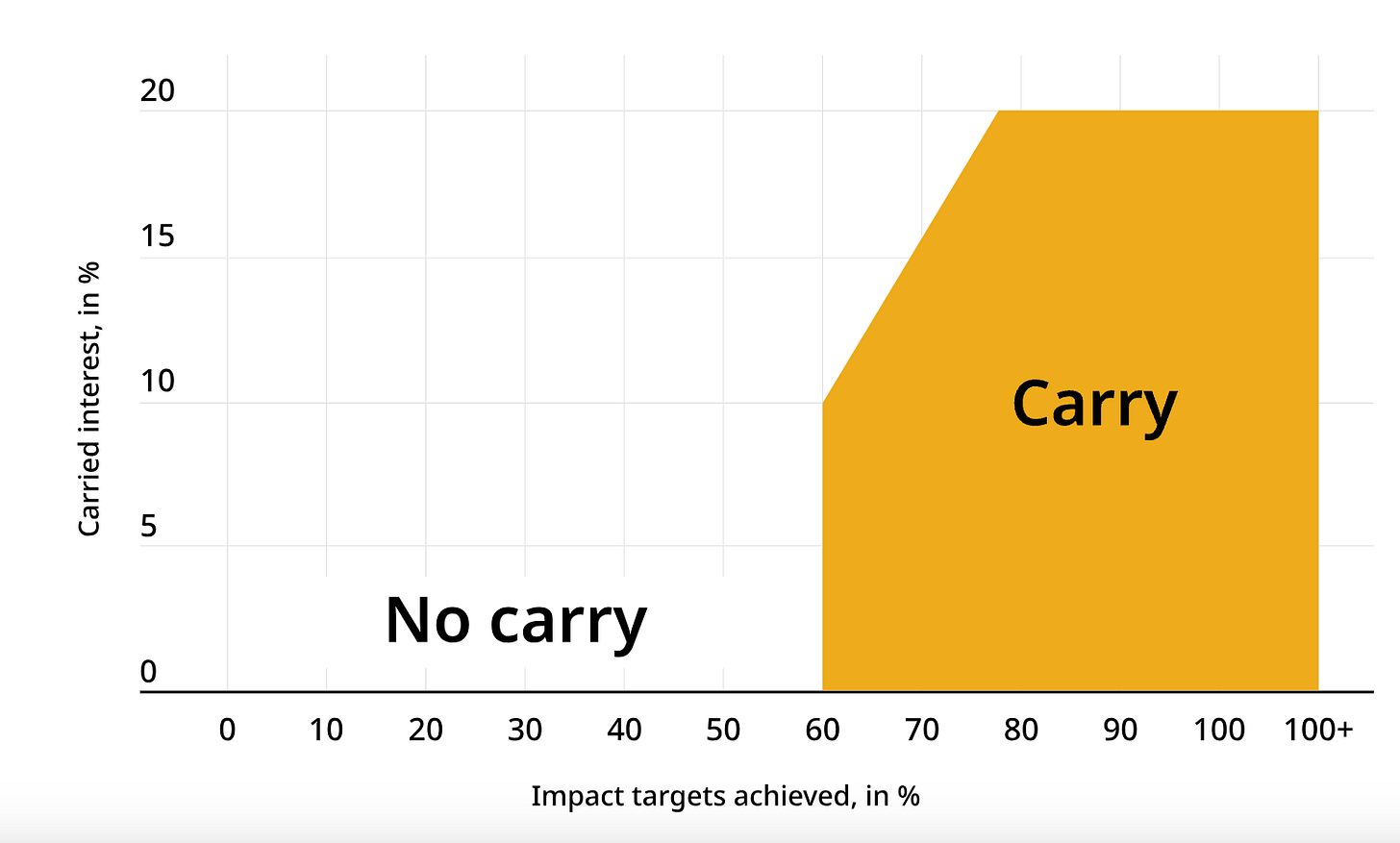

There is no fixed way to implement impact carry as an impact VC, but typically the impact VC sets one or a few impact KPIs and goals per investment made, and then a part of the carry (from 10-50%) is blocked from being paid out to the VC if they don’t meet these goals (Panchal & Bourke, 2022). The EIF has a template for how to structure the impact carry and measure impact goals (Revent, 2022; EIF, 2020) and an illustration of the implementation of that is the graph below. No carry is paid out if at least 60% of the impact goals aren’t met. Above 60% the carry scales in line with the percentage of the target values reached. If 80% of the impact goals are met, they can get full carry (Ananda, 2021; EIF, 2023):

Source: Ananda impact report 2021

Challenges & Discussions 💬

There are still some challenges and questions around impact carry. Research is trying to answer some of these questions, an example is the Impact Linked Compensation research project. I list a non-exhaustive list of challenges and questions below.

There is no globally standardized way of designing impact carry that all LPs agree on (Power, 2022)

There can be a time mismatch between the time a fund closes and the actual impact is happening, which means that it would make more sense to pay out the carry some years after the fund closes to ensure the impact really takes place (Panchal & Bourke, 2022)

It is legally complex to incorporate new impact metrics in the standardized framework of carry (Panchal & Bourke, 2022)

Today impact carry is being used only as a stick and not a carrot. The best carry that an impact fund manager can hope to do is to match the market standard of 20% for non-impact fund managers. So underperformance on impact is punished, but overperformance is not incentivized. Should it be? (Panchal & Bourke, 2022; Meek, 2022)

Risk of prioritizing impact over revenue in cases where it means a higher personal remuneration (Thirion et al., 2022; Mitchenall, 2022)

Risk of imperfect information between the VC, the VC’s board, and the start-up. This makes the impact goals hard to set, especially in a 5-7 year perspective (Mitchenall, 2022)

Should your impact KPI be directly linked to your revenue or not? If your impact is linked to your revenue then the start-up has a lockstep model and multiplies its impact as it grows, but it also makes the impact carry model unnecessary as you will achieve your impact if you achieve revenue. Moreover, it risks biasing the choice of impact KPI as it has to be related to revenue.

How much of your carry should be linked to impact? If you link everything then you risk harming your fiduciary duty, and no matter how much impact you create, it is still the financial results that pay for your carry

What should you do with the carry if you don’t meet your impact targets? Donate it to charity or give it to the LPs? Different funds do different things

Should impact carry be accompanied by impact-linked compensation to all employees in the start-up? To ensure full mission-alignment among all stakeholders (Struewer in Power, 2023)

An alternative to impact carry is to not include impact in your carry model, but rather ensure your impact by donating a part of the carry to non-profits (Raise, 2023; Meek, 2022)

To conclude, impact carry exists to ensure alignment of impact and financial interests among LPs and VCs. It is built on the idea that impact VCs have an impact fidelity criterion as well as having a fiduciary duty and is already implemented in many impact VCs around Europe.

Thanks for reading this week’s newsletter! Let me know what you think of this article - either in the comments section or in my DMs. Please subscribe to stay updated on articles about everything related to impact VC - and share with friends and colleagues. See you next week for another issue! 👋

Links to articles mentioned: