Disclaimer from August Solliv: The views expressed are solely my own, i.e., it’s my Sunday fun work 😉

Key insights:

Interview with Rob Zochowski, President & CEO at The International Foundation For Valuing Impacts (IFVI)

Rob suggests investors and companies of all sizes (public and non-public) should increase their efforts to measure climate and social impact and put a dollar value on the impact - it’s the only way to make it comparable

Ignoring social and environmental impacts is a hidden risk. In Rob’s words: "Equity holders own residual risk - so you'd better account for it."

Impact can reveal hidden value. In IFVI pilots, companies found impact data uncovered growth opportunities and helped optimize their models

Rob believes that we are moving into a world with impact accounting - Rob believes we’re leaving the “early adopter” phase — and entering the acceleration phase of impact accounting adoption

Thanks for reading Impact Supporters! Subscribe for free to receive new posts and support my work.

Greetings to 3k+ Impact Supporters! 🌍 It’s August Solliv 👋 Today we take a broader look at the impact market and how we can create an impact economy (≈6 min reading time). Rob argues that investors are missing key data about the companies they invest in when not taking impact into account:

💡 Impact measurement vs management vs monetization

⚙️ How investors can help companies with impact monetization: Start small and build

🧠 Social vs. environmental impact: Can you really compare?

🚀 Adoption is accelerating

📬 What this means for you as an impact investor

Meet Rob Zochowski 👋

Rob began his career in traditional finance 💼 - at Goldman Sachs, working in various roles within private wealth management and product development. But over time, he began questioning what kind of value he was helping create 🤔 That question led him into academia, impact investing, and Harvard Business School 🎓 where he helped launch one of the most ambitious projects in impact measurement (Impact-Weighted Accounts Project), working for Professor George Serafeim.

Today, he’s the President and CEO of the International Foundation for Valuing Impacts (IFVI) - and one of the leading voices in the movement to integrate environmental and social impact into core financial decision-making.

Meet the International Foundation for Valuing Impacts (IFVI) 💼

IFVI spun out of Harvard Business School in 2022 to tackle a deceptively simple question:

What would happen if we valued social and environmental outcomes in dollars - just like we do revenue or costs?

Most ESG and impact reporting today is fragmented and difficult to compare - whether done by start-ups or large corporates 😕 One company reports on CO₂. Another tracks gender diversity. A third shares water usage 💧 But there’s no consistent way to tell which is doing more good - or more harm.

IFVI’s approach is to translate all those metrics into one common language: monetary value. VCs know everything about monetary value but are not looking at all data today to define it. So IFVI suggests to:

📉 Value pollution as a cost

📈 Value improved health or education as a benefit

📊 Compare impact across and within industries and investments

It’s not about ignoring ESG metrics. It’s about connecting them to outcomes - and making them useful for decisions so we can transform accounting for start-ups and corporates.

N.B. IFVI has just merged with Capitals Coalition recently so in the future the push for Impact Accounting will grow 🚀

💡 Impact measurement vs management vs monetization

Today, impact measurement is mostly used for compliance and storytelling. But Rob believes we’re missing its full potential.

By integrating impact into financial terms and thereby monetizing it, companies and investors can:

✅ See where negative impact creates residual risk

🔎 Identify areas where they’re already creating hidden value

🎯 Make better decisions about product design, pricing, and strategy

One early pilot with a VC-backed company revealed that a core product line had far greater social value than the team had realized 🌟 That insight changed how they marketed the product - and how they pitched it to investors and in sales.

Another case flagged a potential regulatory risk ⚠️ around working conditions - something that didn’t show up in traditional ESG reports but became clear once social cost was quantified 💬

In short: impact accounting turns passive metrics into active management and potential monetization - and has strong value for large corporates but also supports start-ups as they scale.

⚙️ How investors can help companies with impact monetization: Start small and build

Rob is clear that this isn’t an overnight transformation.

IFVI encourages investors and companies to start small (and mostly not in a Pre-Seed company):

🧪 Choose one product, one geography, or one segment

🧮 Apply impact valuation to understand costs and benefits

🔁 Use what you learn to adjust operations — then scale up over time

This approach creates credibility and momentum without overwhelming teams. It’s also a way to build internal buy-in, especially for those skeptical of abstract ESG frameworks.

“Don’t boil the ocean. Pick one pilot, prove the value, then scale.”

From there, teams can iterate, improve, and expand. More products. More geographies. Deeper analysis. As confidence builds, so does internal engagement. Finance teams begin to pay attention. Product managers start asking new questions. Even marketing sees opportunities to tell more grounded, value-driven stories.

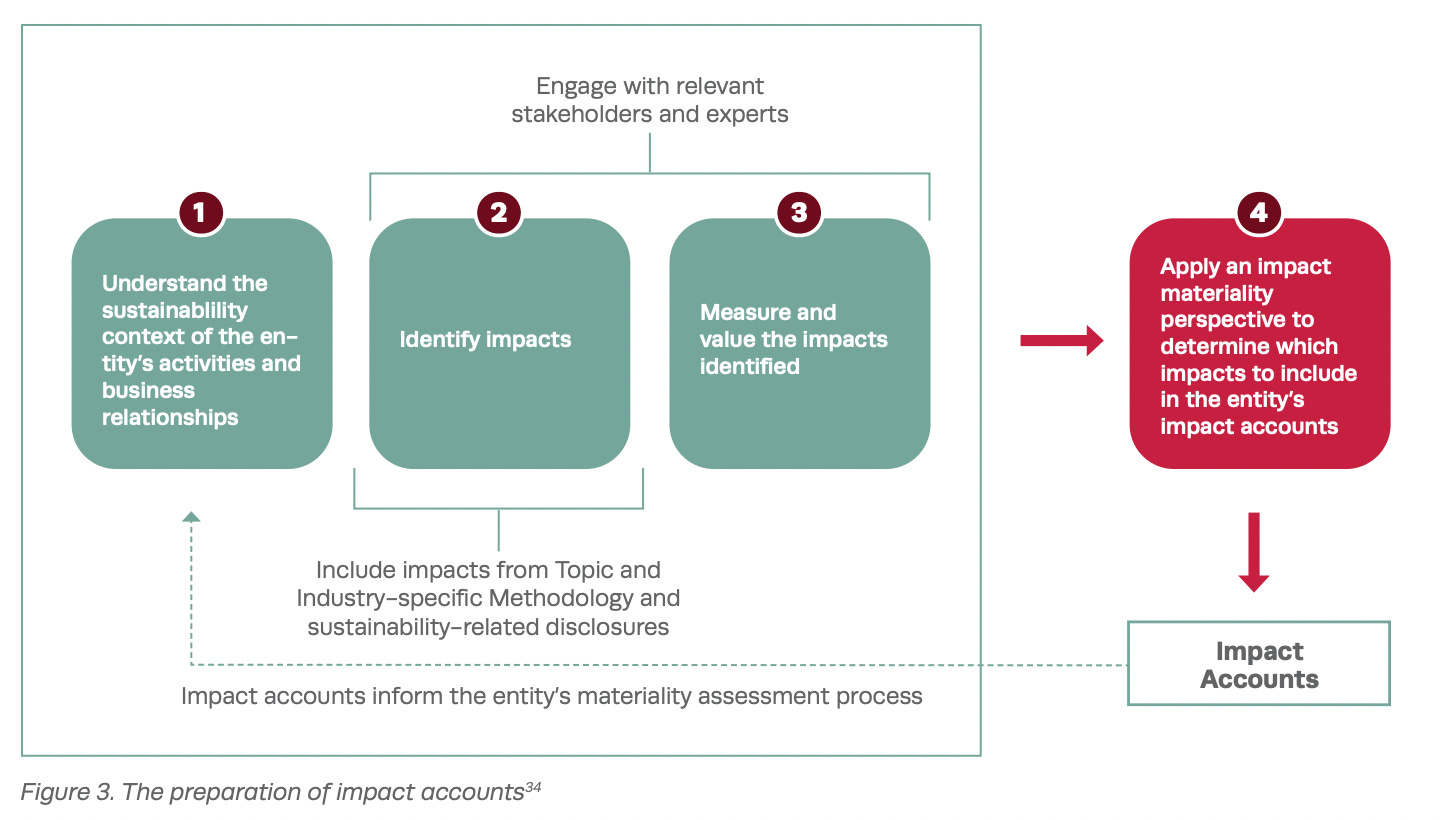

Source: IFVI, 2024a

🧠 Social vs. environmental impact: Can you really compare?

One of the biggest philosophical hurdles in impact measurement is comparability. How do you weigh clean air against mental health? Or biodiversity loss against income inequality?

IFVI’s answer: use well-established social science to assign consistent, monetary values to outcomes - even the tricky ones 🔬

For example, the cost of underpaying workers can be estimated based on the local living wage gap. The benefit of improved air quality can be linked to reduced healthcare costs and increased productivity. A premature death - something regulators already quantify - has a statistical economic value that can be applied globally, not just based on national GDP. Rob says he can’t truly put a financial value on a life but he can use academics’ best estimates of various impacts costs / benefits to society.

Source: IFVA, 2024b

It’s not perfect 😅 But it’s better than ignoring the value altogether — or relying only on what’s easy to measure ✅

“You wouldn’t make a financial decision using only half the data. So why do that with impact?”

Source: IFVI, 2024a

🚀 Adoption is accelerating

So where are we in the journey? 🗺️

Rob believes we’re leaving the “early adopter” phase and entering the next wave of growth 📈 The concept of impact-weighted accounting is now being discussed not just in academic papers or niche funds — but also by institutional investors, corporates, and regulators 🏛️

Summa Equity (whom we have already hosted on Impact Supporters) is an example of an investor that is already trying to measure the impact of its portfolio in monetary value 💸

IFVI is actively building open-source tools, training programs, and partnerships to make adoption easier 🧰 They’re also working with funds like Summa Equity and others to run pilots and generate case studies 📊

The goal isn’t just better measurement. It’s creating a common baseline that the entire market can use - much like GAAP or IFRS for financials.

📬 What this means for you as an impact VC

Rob says that if you’re in venture or growth equity, this is your chance to support your start-ups in getting value out of impact measurement.

You’re investing in companies before their operations are locked in. You have influence over business models, incentive structures, and impact ambitions. Most importantly: you have a chance to shape how value is defined.

So start small:

✅ Try one valuation pilot

💬 Talk to your portfolio founders

📈 Use what you learn to improve both performance and purpose

And remember: this isn’t about “adding” impact 🧩 It’s about seeing the full picture of the value you’re already creating — or destroying 🔍 Rob also suggests that you, as an impact VC, look at ways to include generalist VCs in impact management 🤝

You can find the tools, resources, and case studies for impact valuation on this website, the Impact Valuation Hub. IFVI and Capitals Coalition will continue to participate in this initiative and support it as a merged entity.

Thanks for reading this week’s newsletter! Let me know what you think of this article and who else I should interview in this series - either in the comments section or in my DMs. Please subscribe to stay updated on articles about everything related to impact VC - and share with friends and colleagues. See you next week for another issue! 👋

Links to articles/data mentioned: