Disclaimer from August Solliv: The views expressed are solely my own i.e. it’s my Sunday fun work 😉

Key insights:

Interview with Ryan Grant Little, a jack of all trades in impact incl. angel investing in climatetech 🌱

Two of Ryan’s key learnings are that as an impact angel, 1) you see the losers before the winners, and 2) you get the most value from cooperating with other angels and VCs to deploy smaller tickets at first and ensure not taking too much of the founder’s time for the DD 🤝

Ryan’s top tip for founders raising from impact angels: “If you want advice, ask for money. If you want money, ask for advice.“ 💡

Ryan argues that impact VCs should keep on investing in foodtech in the current economic environment: most foodtech solutions are just making our food system more efficient - it’s not only a question of whether they want to fight emissions 🌍 but just as much about it being efficient to feed and slaughter cows 🐄

Thanks for reading Impact Supporters! Subscribe for free to receive new posts and support my work.

Greetings to 3k+ Impact Supporters! 🌍 This is August Solliv writing 👋 Let’s dive into angel investing in climate/impact. Some of our readers cooperate a lot with impact angels (i.e. impact VCs), some are impact angels themselves, and some are considering becoming impact angels. This one is for all of you! (≈6 min reading time):

The foodtech investment thesis 🍽️

Uncertainty of foodtech investing 🤔

Write-offs and write-downs as an impact angel 📉

Learnings as an impact angel 🎓

Tips for founders raising impact angel rounds 🚀

Meet Ryan Grant Little👋

Ryan is a climatetech advisor, investor, mentor, volunteer, consultant, and anything else related to climatetech 🌿 He spends 33% of his time managing his portfolio of start-ups and investing, 33% on mentoring and volunteering, and 33% on consulting work. He is also the founder of ‘Another ClimateTech Podcast‘, which I can recommend if you want to get insights from climate start-ups primarily and some investor and research perspectives 🎙️

Ryan is a serial entrepreneur. Here are some examples. He launched one of the first B2B e-commerce companies before the dot-com bubble, then the largest donations platform in Canada, powering all Canadian charities and facilitating USD 3bn of donations. Ryan then went on to also launch a biogas company in Canada, that he exited in 2010 and that operated in North America.

Ryan’s investment approach 💼

Ryan has been an angel investor for 4 years. His journey into angel investing started with Ryan investing in and then running one of his friend’s profitable SaaS companies in 2018, which the friend didn’t want to run anymore. The start-up was not in climate, but Ryan agreed to run it solely for the potential economic payout 💵 The company exited in 2021 and Ryan got a solid pool of cash that he then decided would be his war chest for climatetech angel investing 🔥

Ryan was then searching to find out what his investment thesis should be. He heard a podcast about the case for foodtech as a key component of climatetech and matched that with his experience as a founder in biogas and experience from slaughterhouses and factory farming. So he decided to focus his angel investments on foodtech. Today Ryan has 25 companies in his portfolio.

The foodtech investment thesis 🍽️

Ryan sees 2 advantages to his choice of foodtech as investment focus:

Foodtech is very close to Ryan’s values ❤️ Ryan loves animals and has been a vegetarian for 20 years. So foodtech is close to his values, which he believes is a force when investing.

The food industry accounts for 20-30% of CO2 but only attracts about 8-10% of investment capital today (PwC, 2024) 🌍 so there is a big impact potential.

Uncertainty of foodtech investing 🤔

Ryan admits that the reason some sectors might be underfunded is that they are not adapted to VC investing i.e. hurdles and infrastructure might hinder rapid growth. He, however, believes in foodtech because even if you don’t think about foodtech from a climate perspective, then it makes sense. As he says:

You could just look at it purely from an efficiency standpoint. There's no stupider way to make a hamburger than to grow a cow from nothing - feeding it, housing it, slaughtering it, and then processing it 🍔 There are much better ways, whether it's plant-based or from mushrooms 🍄 - or soon from cultivated meat 🧫

Write-offs and write-downs as an impact angel 📉

Ryan has had write-offs and write-downs in his portfolio. Ryan warns other impact angels that this can be truly discouraging - as it can be because founders or other investors are not engaging themselves enough. And it can be even more discouraging if the company is actually great and solving a major issue, but is struggling because the funding market is not doing well 💸

Ryan’s primary advice is that you should only be angel investing with money that you are ready to lose - that’s what he does. Otherwise, write-offs and write-downs will create too much stress for you as an angel 😓

Learnings as an impact angel 🎓

Ryan shares the following:

You see the losers before the winners most of the time. So, you'll see a lot of the companies you invest in, flame out in 12 or 18 months 🔥 Whereas the big exits might take 3-5 years or much more…

Ryan underdid the DD work at the beginning. He thought “The round is a couple of million bucks and you're coming in as an angel with 50k so you shouldn’t take up too much time“ ⏳ The founders don’t have the same time for you as for the big investors and you can’t expend too many resources yourself on an investment this size as it can affect the return, so you have to manage your DD efforts well. What he does now is that he collaborates with a strong network of other angels and VCs that he then relies on for part of the DD 🤝 Ryan then focuses his part of the DD on the founders only - he wants smart, humble, and hungry founders - and screens out narcissists 🚫

Tips for founders raising impact angel rounds 🚀

Ryan shares the following:

There’s an expression that goes: “If you want advice, ask for money. If you want money, ask for advice.“ Ryan prefers the founders who get to know him and build a relationship - as it proves to Ryan that they know how to build relationships over time and makes sure that he can add value to the start-up 💡

Look for more than just a cheque. Find people that can bring you some value - as the capital is only a small part of it 💰

Ryan likes sales-driven founders. He believes in founders that make a good and solid product, but even more so spend a lot of time with potential customers and build relationships 📞

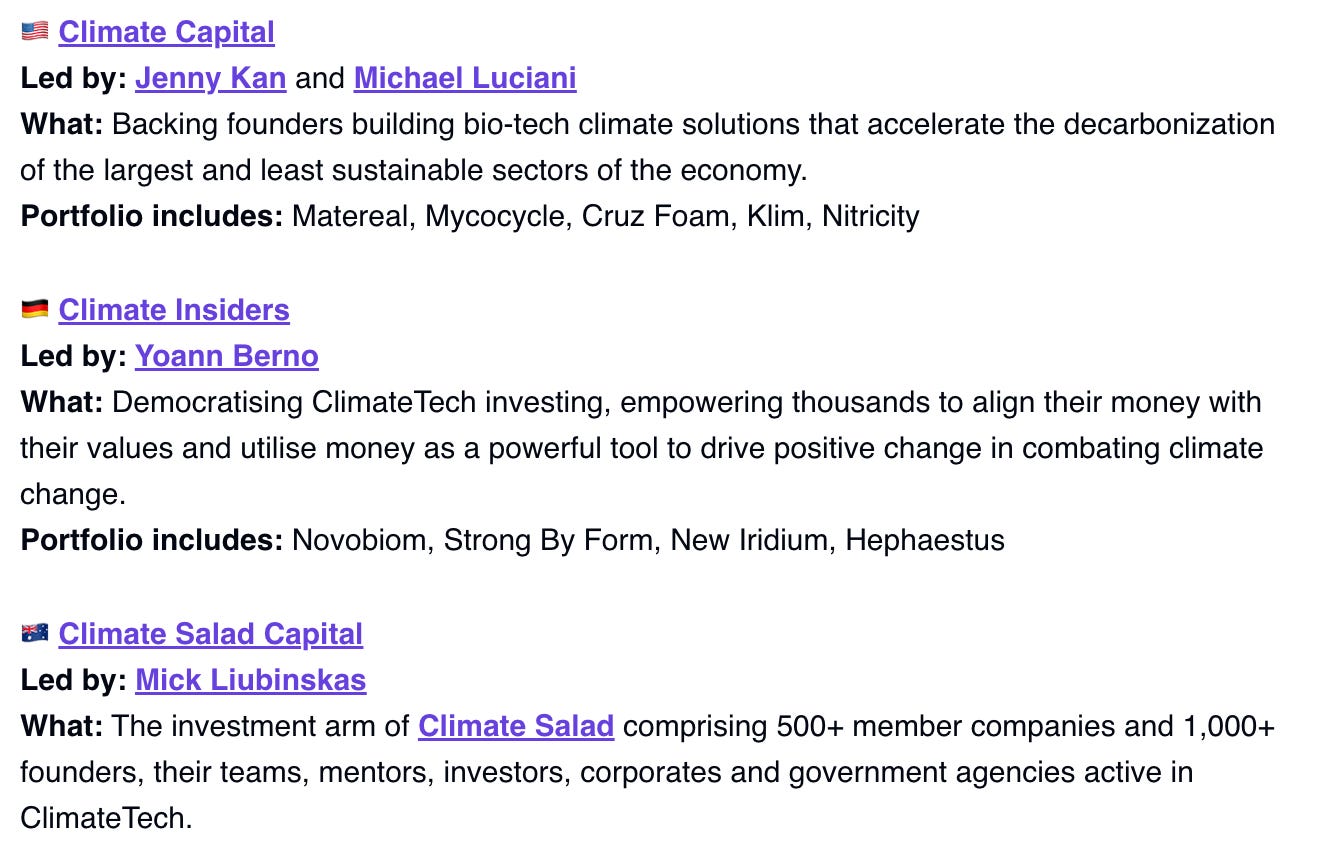

If you want to know the most active climate tech angels in Europe, look here:

If you want to find a climate angel syndicate to co-invest with, look here:

HackSummit, 2024 - and see a snippet below 📌:

Thanks for reading this week’s newsletter! Let me know what you think of this article and who else I should interview in this series - either in the comments section or in my DMs. Please subscribe to stay updated on articles about everything related to impact VC - and share with friends and colleagues. See you next week for another issue! 👋

Links to articles/data mentioned:

Share this post