Disclaimer from August Solliv: The views expressed are solely my own i.e. it’s my Sunday fun work 😉

Key insights:

Interview with Isabelle Canu, Partner at GET Fund, and Beatrice Böhm, Principal at GET Fund

The GET Fund uses the Triple Top Line for their impact measurement - they argue for a holistic set of impact KPIs for deals - and include social equity discussions with all climatetech start-ups

Isabelle and Beatrice are discussing impact measurement already early with start-ups in due diligence to ensure impact alignment

Greetings to 3k+ Impact Supporters! 🌍 This is August Solliv writing 👋 Let’s dive into the Triple Top Line (≈7 min reading time):

The Triple Top Line 🌱

Integrating economic and social considerations into climatetech 🌍

KPIs and Impact Measurement 📊

Due diligence vs holding period 🧐

Impact measurement challenges ⚠️

Potential vs realized impact 📈

Impact measurement by investment stage 🎯

Tips to other impact VC investors 💡

Meet Isabelle Canu and Beatrice Böhm 👋

Isabelle is a Partner at GET Fund. She is from France originally and studied in Paris before moving to Germany many years ago. She has since worked 25 years in finance - half of it financing start-ups and venture capital. Isabelle by chance started working on sustainable finance 20 years ago when she worked for the German federal chancellery. She started on a program for energy renovations of buildings - and it was the first time that she added non-financial KPIs to financial products - and she now continues on that journey with GET Fund.

Beatrice is a Principal at GET Fund. She is from Romania originally and moved to Munich many years ago for her studies. She has since been with GET Fund for 7 years. To mention some of Beatrice’s work at the GET Fund, she has worked with supporting portfolio companies within energy primarily, as well as established sustainability assessments in their last fund 🌱

Meet GET Fund 💼

GET Fund stands for Green European Tech Fund. The firm has 10+ years of experience investing in climatetech and focuses on Series A and B companies within energy, mobility, industry, and food. GET Fund focuses on what they call “digitally enabled cleantech solutions” - i.e. hardware with a software layer on top 🌍

Initial tickets are €3-5m (which will increase to €7m as they continue fundraising) and GET Fund has pockets for larger follow-on investments 💰

The Triple Top Line 🌱

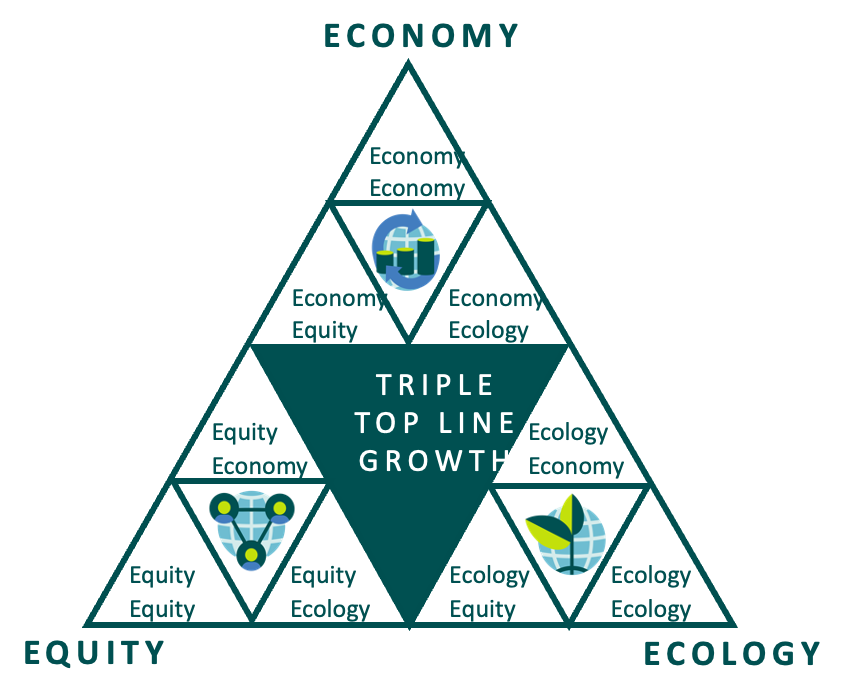

The Triple Top Line is a framework that was invented by Professor Braungart and Professor McDonough, who are also the inventors of the cradle-to-cradle principle. The Triple Top Line started in product development where the idea was that when developing a new product, the developers should have a holistic view of the three pillars of economy, ecology, and social equity. Now GET Fund uses it for business model development as their impact measurement framework 🌍

The way the GET Fund uses the framework is that for each investment, they do a triple top line assessment and define nine KPIs per portfolio company as the intersection between themes in the framework. Some KPIs are common across investments, e.g. CO2e emissions savings - whereas others are unique for each company 🔑

Source: GET Fund

Integrating economic and social considerations into climatetech 🌍

GET Fund only invests in climatetech, so they have no focus on impact topics such as edtech and healthtech. Isabelle and Beatrice, however, argue that they believe there is an interplay between the dimensions and a value-add in including the social dimension of climatetech start-ups. Some of the areas they look at when examining the social side of climatetech start-ups are: 1. the educational role of the company, 2. the inclusion the company has to get people on board the energy transition, 3. the inclusion the company has to ensure employees also profit from successful exits.

This differentiates GET Fund from others, as it brings a holistic aspect to climatetech innovation and company building 💡

KPIs and impact measurement 📊

Many start-ups have different criteria from their various investors about what to report on and what impact criteria to include. Isabelle argues that it should be easy for start-ups to use, therefore, she believes that the Triple Top Line works well. It can incorporate impact KPIs defined by other investors and is flexible to the needs of each company. E.g. Isabelle argues that it doesn’t make sense to do an LCA for every single start-up investment, but rather only do it if it adds value to the specific company you are working with. The Triple Top Line gives that flexibility - and she recommends the framework to other climate VCs considering how to build their impact measurement 📊

Interestingly, Isabelle notes that toward their LPs, GET Fund only uses a subset of their nine KPIs in reporting - and it’s primarily the environmental ones as that’s the ones that LPs request as they report on it themselves.

Due diligence vs holding period 🧐

Beatrice would argue that the groundwork for the impact measurement happens in the due diligence (DD) phase - and is monitored in the subsequent holding period as investors need to assess in-depth the product and business model.

In the due diligence, Beatrice argues that the impact assessment must come early in the process for impact investors, as it must be regarded as just as key as financial due diligence. More specifically, Beatrice says that she mentions the Triple Top Line in one of the first calls with their start-ups - and then later on in the DD they do a workshop on the Triple Top Line to define impact KPIs and set targets on these 🎯

The way that GET Fund organizes impact measurement is that every investment manager leading a deal is responsible for the impact measurement on the deal - so the ownership is divided out in the firm 💼

Impact measurement challenges ⚠️

Beatrice names one clear primary challenge and that is access to data. Some start-ups lose access to the data on their products once they are sold - then it’s hard to measure e.g. cradle-to-cradle impact of the product. Beatrice tries to work with start-ups that lack data to find out how they can access or estimate it at least 🔍

Potential vs realized impact 📈

GET Fund creates estimates for the potential impact of every deal they make. The basic rule is that impact and business success should be related - so as long as the start-up succeeds commercially, it is an impact success. However, the primary issue with potential impact calculations is actually that it is very hard to estimate the time of exit of an investment 🕒

In general, Beatrice would advise funds to work with an approx. 2 years delay on financial and impact business plans - from experience that has fitted well with GET Fund portfolio companies 📝

GET Fund follows the EIF standard framework for whether a deal has been successful. For every deal, they have a company impact multiple i.e. the ratio between the actual impact at exit and the planned impact, which covers 1-5 impact KPIs with various weightings.

Impact measurement by investment stage 🎯

Isabelle argues that the Triple Top Line can be used at all stages by start-ups. Perhaps at Pre-Seed and Seed, start-ups don’t need 9 KPIs but at least define the direction in which they want to go. In Series A and Series B, they then go more nitty gritty.

A learning that Isabelle shares is that especially at even later stages a proper ESG and impact analysis becomes key for the next financing rounds and for exit discussions. So it is helpful to start a bit early to prepare for the later and later rounds - as well as to make sure that you have gathered enough relevant data 📈

Tips to other impact VC investors 💡

Beatrice would advise other impact VCs to look at impact measurement from the start-up’s lens as well sometimes - the key is to find the right KPIs that can be measured and communicated realistically by the start-up 🔑

Isabelle would similarly say that the key to successful impact measurement is relevant and strategic impact KPIs to keep the start-up team motivated and on track 🚀

Thanks for reading this week’s newsletter! Let me know what you think of this article and who else I should interview in this series - either in the comments section or in my DMs. Please subscribe to stay updated on articles about everything related to impact VC - and share with friends and colleagues. See you next week for another issue! 👋

~ August

(As these photos show, I’m an actual human writing this newsletter. Not AI. 🤖)

If you liked this article, you might also like this previous interview about impact measurement:

Links to articles/data mentioned:

Share this post