Disclaimer from August Solliv: The views expressed are solely my own i.e. it’s my Sunday fun work 😉

Key insights:

Interview with Danijel Višević, Co-Founder and General Partner at World Fund

Resilience is to be “able to withstand crisis and to stand on your own two feet”

Europe is further from being resilient than other global regions because of our high reliance on other countries through trade

cylib, a World Fund portfolio company, is a great example of the types of solutions that we need to build a resilient future - they are a battery recycling company that is working to help recycle lithium, graphite, cobalt, and other rare metals to be able to produce these materials in Europe directly and cheaper than current alternatives

4 categories at the intersection of climate and resilience: 1. Energy, 2. Food, Agriculture & Land Use, 3. Frontier Tech, and 4. Raw Materials (World Fund has also identified sub-categories - check out the end of the article for those)

Greetings to 3k+ Impact Supporters! 🌍 It’s August Solliv 👋 Let’s dive into the importance of climatetech for resilience in Europe - and the overlaps between climatetech and resiliencetech. Danijel has spent years looking into the topic and recently released a very relevant white paper (link at the end) (≈7 min reading time):

Definition of resiliencetech 📖

Industries in resilience 🏗️

Investing in a green premium 💸

“Climatetech is dead?“ 💀

Tips for other investors in the impact VC space 😉

Meet Danijel Višević 👋

Danijel’s background is in journalism in Germany 📰 He is an economist by education and started his career writing for newspapers like Handelsblatt before moving into television and working for Deutsche Welle. Later he switched profession to instead support politicians with their personal brand and communications 🎤 Danijel amongst others worked five years for Angela Merkel when she was German Chancellor (2012-2017) 🇩🇪

Danijel has always believed in working with a purpose and vision - and that if you do this, it will make even more money than if you don’t. This led him to get into VC by launching World Fund.

Meet World Fund 💼

World Fund was launched in 2021. Danijel launched the impact VC firm together with Tim Schumacher and Daria Saharova. World Fund held a final close of their first fund at €300m in 2024. They invest in climatetech with a focus on decarbonization at the core.

World Fund only invests in solutions with the potential to save at least 100 Mt of CO₂ emissions per year by 2040 🌱 They work with a methodology called “Climate Performance Potential“ (CPP) to only invest in solutions with a top climate potential 📈 It builds on the work of 100 scientists in Project Drawdown, a book that came out in 2016-17, which was later spun into Project Frame 📚

Definition of resiliencetech 📖

Danijel says that resilience has been a topic in politics for the last many years, but it has only gotten a lot of focus in the public space in the last months and years ⏳ Danijel defines resilience as being “able to withstand crisis and to stand on your own feet” and resiliencetech as being the tech that increases our potential to enable us to withstand crisis 🛡️ In Europe, through our investments in trade, we have, however, become very reliant on our trade partners and have decreased our resilience - even more so than other continents 🌐

“As outlined by the Draghi Report, to attain policy goals, investment needs are higher than ever: To digitalise and decarbonise the economy and increase our defence capacity, the investment share in Europe will have to rise by around 5 percentage points of GDP to levels last seen in the 1960s and 70s.“ (EU, 2024 and World Fund, 2025).

Danijel sees becoming more resilient as a key problem for Europe in the next years and, therefore, he believes that start-ups supporting the resilient transition have a large commercial potential. These solutions, however, can not have a green premium and must be more convenient, cheaper, and better than the others in the industry.

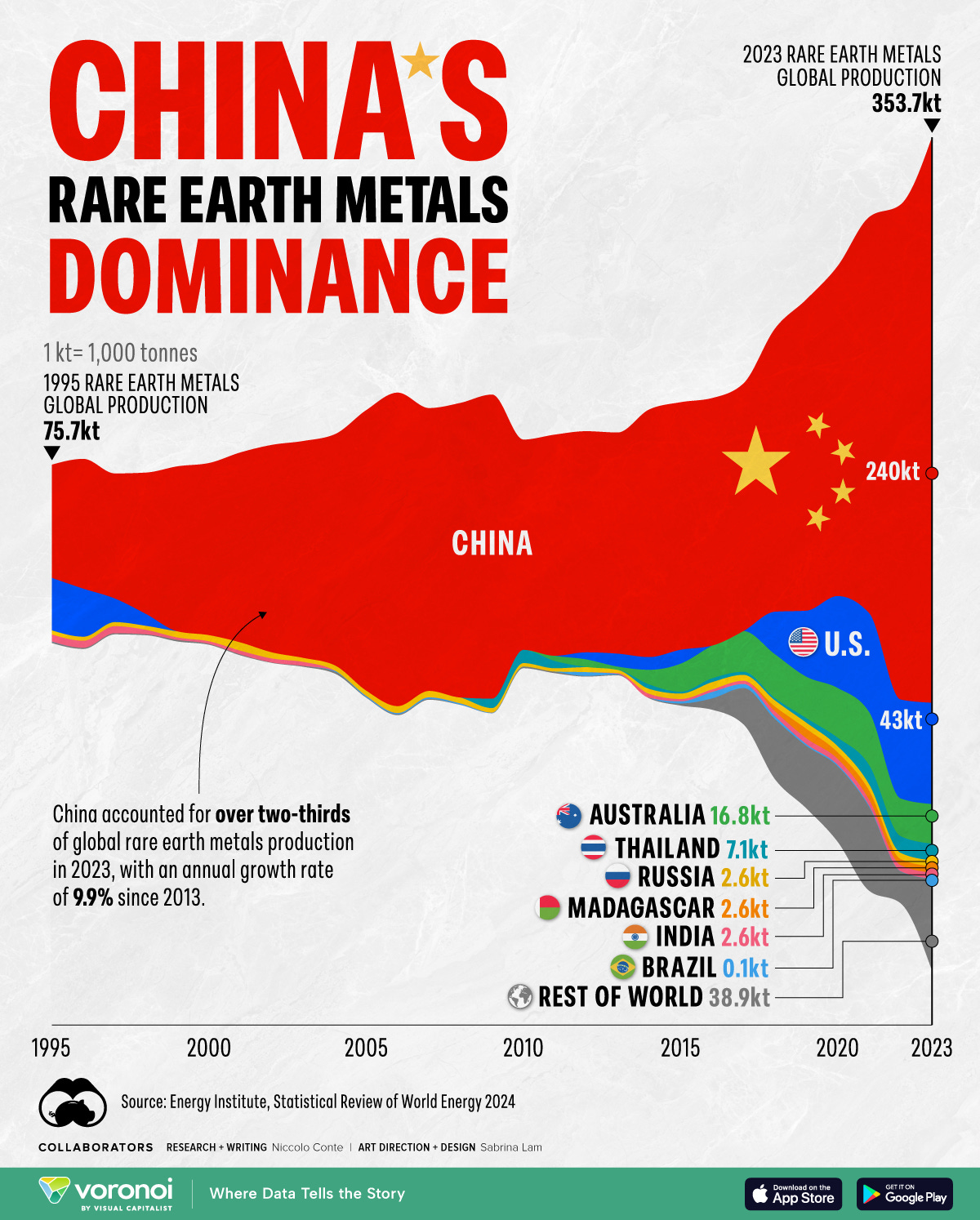

Danijel gives the example of cylib - a battery recycling company that is working to help recycle lithium, graphite, cobalt, and other rare earths to be able to produce these materials in Europe directly and cheaper than current alternatives - cylib would make the continent less reliant on rare earth minerals from other regions 🔄

Source: Visual Capitalist, 2024

Resilience can also be seen as risk mitigation when you are DDing a start-up. For example, World Fund asks in some deals “would we invest in companies that are highly dependent on supply from China?” or “would we invest in companies that are highly dependent on raw materials that come from outside of Europe“.

Industries in resilience 🏗️

Danijel highlights that resilience covers an array of industries that have traditionally been associated with climatetech 🧩 You find resilience topics in energy and food for example. Resilience, however, also goes beyond that. It also covers defensetech for example, which has never been an impact topic. See the end of the article for a full split of industries in resiliencetech.

[Note from the author: I asked Danijel teasingly if defensetech would become the next frontier of impact VC as we see economies in Europe prepare increasingly for war ⚔️ Danijel doesn’t believe so as the purpose of defensetech is defense, but the cause is also to attack. World Fund does, however, invest in dual-use solutions that are both selling to commercial and defense players 💬]

Investing in a green premium 💸

Danijel says that the World Fund has never been comfortable with businesses relying on a green premium 💸 As Danijel sees it, there are enough climatetech opportunities that not only can survive but thrive without a green premium and big regulatory support (e.g. subsidies). Danijel prefers to invest in those types of solutions.

An example that Danijel highlights is Planet A Foods 🍫 They are producing cocoa in Europe and help avoid both cutting down rainforests to plant cocoa trees and exploitative agriculture using child-labor 🌳 Planet A Foods’ chocolate is partially even healthier, cheaper, and with lower risks in the supply chain than traditional chocolate.

“Climatetech is dead?“ 💀

Danijel sees changes especially in the US to the use of the term climatetech 🇺🇸 In the US, scientists are explicitly told not to use the word ‘climate‘ if they are applying for funding 🚫 The same goes for ESG and impact in the USA 📉

World Fund will still invest in climatetech and continue to call the industry climatetech 🔁 Danijel explains it as:

Already with the first fund in 2021-22 when climate was really in vogue, we mainly spoke about the financial opportunity because, in the end, we need to generate superior returns to prove that when you do this kind of climate investing we do - you must generate more capital. It is still to be proven, still to be shown, and very risky, but we believe in it.

No LP would have given you capital, even not in 2021, if you were pitching your fund based on the climate crisis and our need to avoid it. The LP would immediately ask you, “Ok, how will you return more money than I give to you?” And that's totally fair. That's their job.

Tips for other investors in the impact VC space 😉

The World Fund classifies resiliencetech solutions into 4 categories with underlying sub-categories. You get them here:

Energy

Preparing European grids for the energy transition

Scaling battery storage to support renewable energy reliability

Empowering energy independence through flexibility and microgrids

Develop and scale new energy carriers and molecules

Food, Agriculture & Land Use

Cutting agricultural input dependencies

Boosting crop climate resilience

Embracing regenerative farming practices

Reducing meat consumption and innovating local protein production

Reducing local cocoa & palm oil dependence

Frontier Tech

Quantum computing

Semiconductors

e-Aviation

Space tech: expanding the final frontier

Raw Materials

Reduce: Minimising resource dependency

Reuse: Extending product and component lifecycles

Recycle: Closing the loop on materials

Danijel would also advise other investors to speak up more about the changes that they see in society 🗣️ Authoritarianism is growing globally and he, therefore, sees a need to grow "personal resilience” - and calls on all everybody reading this, to start acting 🚨 Danijel believes that it will also make you a better investor as you will build a thesis around resilience 📐

If you want to learn even more, you can read the whitepaper that World Fund has released on resilience for climate VCs entitled “The importance of climate tech for European Resilience“: World Fund, 2025 📖

Thanks for reading this week’s newsletter! Let me know what you think of this article and who else I should interview in this series - either in the comments section or in my DMs. Please subscribe to stay updated on articles about everything related to impact VC - and share with friends and colleagues. See you next week for another issue! 👋

Links to articles/data mentioned:

Share this post